Talking Points:

- EUR/USD Squeezes Higher; DailyFX SSI Highlights Drop in Open Interest Ahead of Greek Election.

- GBP/USD Fails to Hold Support; At Risk for Further Decline on Dismal 4Q U.K. GDP Report.

- Bullish USDOLLAR Outlook Mired by 2015 FOMC Rotation; Vote Count in Focus.

For more updates, sign up for David's e-mail distribution list.

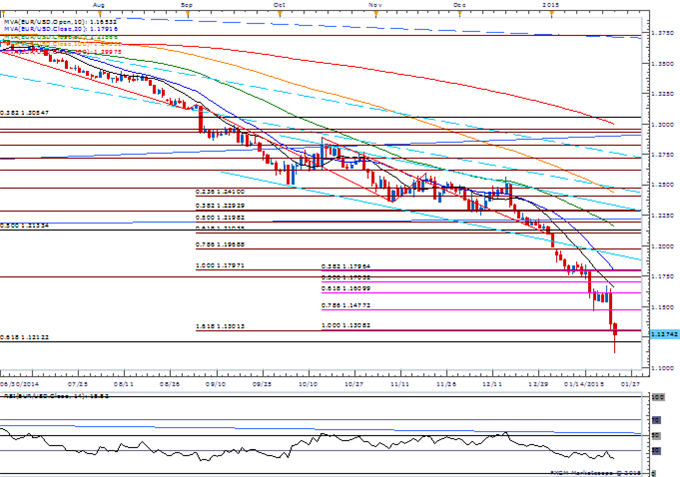

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD rebounds from a fresh monthly low of 1.1113, but downside targets remain favored as the Relative Strength Index (RSI) holds and pushes deeper into oversold territory.

- May see increased volatility in EUR/USD at the Sunday open following the Greek elections on January 25 amid the renewed threat for contagion.

- Despite the increased volatility in the DailyFX Speculative Sentiment Index (SSI), open interest on EUR/USD has fallen nearly 9% going into the last full week of January, largely driven by a decline in retail short positioning.

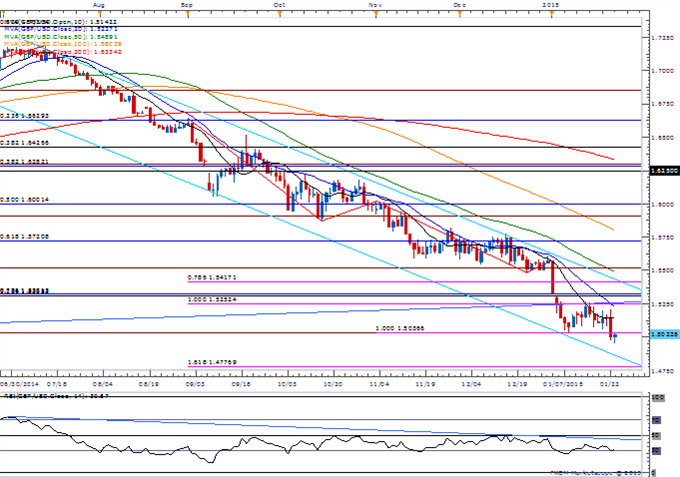

GBP/USD

- GBP/USD slips to 1.4950 despite the 0.2% rise in U.K. Retail Sales; will keep a close eye on the RSI as it flirts with oversold territory.

- U.K.’s 4Q Gross Domestic Product (GDP) report is expected to show the economy growing 0.6% versus 0.7% during the three-months through September; will it reinforce a wait-and-see approach for the Bank of England (BoE)?

- Nevertheless, will continue to favor the downside for GBP/USD as price & RSI retain the bearish trends carried over from the previous year.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

GBPNZD At Key Channel Resistance

USDOLLAR(Ticker: USDollar):

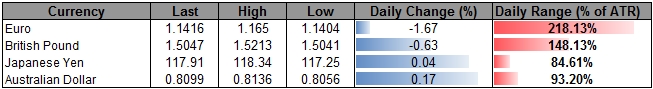

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11749.67 | 11753.51 | 11669.34 | 0.40 | 144.47% |

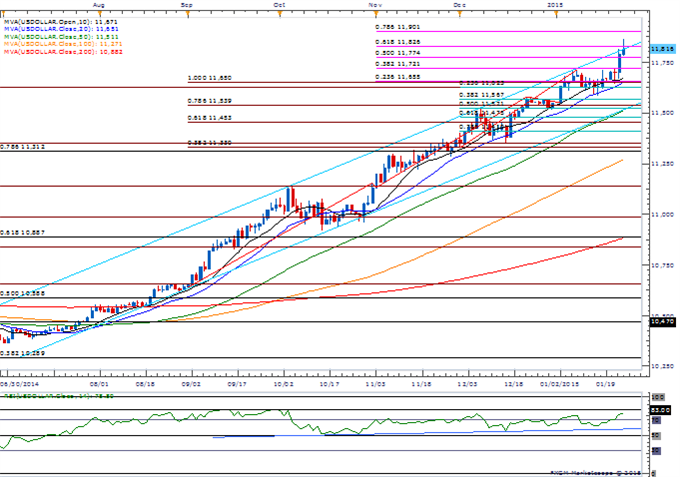

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar pares advance to 11,863 as it fails to benefit from the slew of mixed data prints; Federal Open Market Committee (FOMC) interest rate decision may set the tone for the February trade following the 2015 rotation.

- Beyond calls for a mid-2015 rate hike, will keep a close eye on the vote count as the 2014 dissenters (Richard Fisher & Charles Plosser) lose their vote on the committee.

- Need a close above 11,826 (61.8% expansion) to favor a more meaningful run at 11,901 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| Chicago Fed National Activity Index (DEC) | 13:30 | 0.48 | -0.05 |

| Markit Purchasing Manager Index Manufacturing (JAN P) | 14:45 | 54.0 | 53.7 |

| Existing Home Sales (DEC) | 15:00 | 5.08M | 5.04M |

| Existing Home Sales (MoM) (DEC) | 15:00 | 3.0% | 2.4% |

| Leading Index (DEC) | 15:00 | 0.4% | 0.5% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums