S&P 500 FUNDAMENTAL FORECAST: BULLISH

- The S&P 500 index may weather through near-term headwinds and aim for higher levels

- So far in the earnings season, over 80% of the index’s constituents have beaten estimates

- US election and slower recovery are the key risks amid a second viral wave

S&P 500 Index Outlook:

The S&P 500 index retreated from a six-week high since the start of the earnings season, in which big American banks delivered strong Q3 results. US banks were benefiting from lower loan-loss provisions and higher trading income amid improved market conditions. More than 80% of the S&P 500 companies, which have released results so far, have smashed analysts’ forecasts. This may set an upbeat tone for the rest of the earnings season.

This week, around 17% of the S&P 500 companies will unfold their Q3 results, include Procter & Gamble, Netflix, Abbott, Coca-Cola, AT&T, American Airlines, Intel and American Express.

The second US fiscal stimulus package remains a key focus too. As investors count down for the US presidential election, the likelihood for a program to be approved before 3rd November appears to be thin. This assumption, however, may not totally deter investors from risk-taking as recent polls point to a strong lead for Joe Biden over Donald Trump, which may pave the way for a Democratic-led relief package that markets seem to favor. A ‘blue wave’ election outcome could mean Democrats in charge of the White House, Senate and House, removing hurdles to pass substantial fiscal support for the US economy.

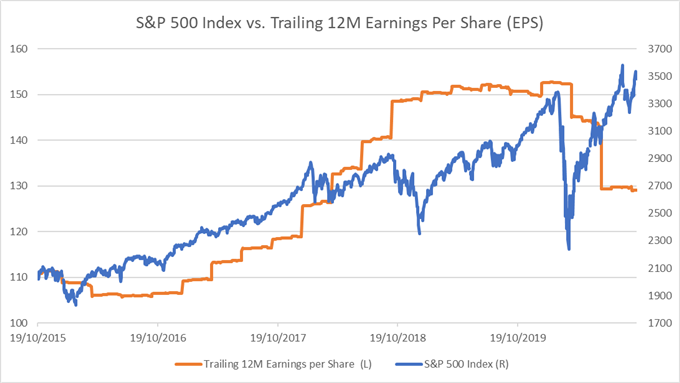

S&P 500 Index vs. Trailing 12 month EPS (2015-2020)

Source: Bloomberg, DailyFX

Some near-term headwinds include election risks and a ‘second wave’ of coronavirus in parts of the world, which could dampen a fragile recovery. US jobs data has shown early signs of weakness with an unexpected rise in the jobless claims number last week. Chinese CPI and PPI readings both fell short of expectations, underscoring weaker demand for factory output from the world’s second-largest economy.

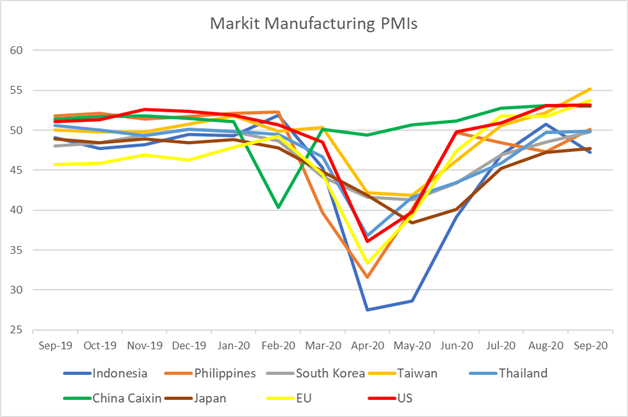

Markit Manufacturing PMIs also pointed to a mixed recovery across the Asia-Pacific, the EU and the US in the recent months (chart below). Taiwan registered a strong PMI readings of 55.2 in September, whereas Indonesia’s figure has swung back to 47.2 from 49.7. The European Union and the United States extended their expansionary trajectory, with both manufacturing PMIs scoring above 53.0.

Manufacturing PMIs across Asia-Pacific, EU and US – Past 12 months

Source: Bloomberg, DailyFX

Back to US markets, the recent selloff in equities appeared to be another healthy correction in a bull run and there seemed to be a lack of evidence of systemic risk. In the medium term, the US economy may ride a slow but steady recovery from the Covid-19 pandemic with support from comprehensive fiscal aid, vaccines and an accommodative monetary environment.

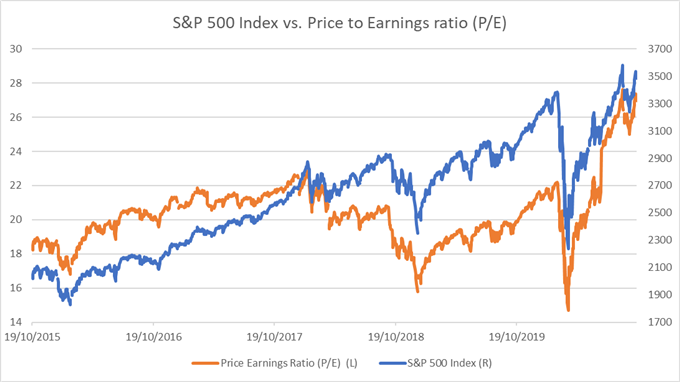

The S&P 500 index is trading at around 27.0 times price-to-earnings (P/E) ratio, which is above its five-year average of 20.3 (chart below). A mean-reversion move is possible without a significant pullback in stock prices, if earnings continue to improve alongside a broader economic recovery. The Fed’s commitment to keep interest rate unchanged before at least 2023 with unlimited QE may help to contain potentially emerging credit risks and boost equity market with ample liquidity.

S&P 500 Index vs. Price to Earnings ratio (P/E)

Source: Bloomberg, DailyFX

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter