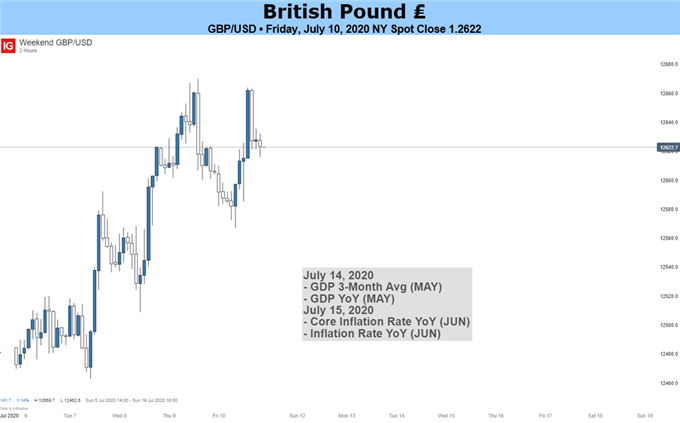

Source: IG Charts

GBP/USD FUNDAMENTAL HIGHLIGHTS:

- Significant Differences Persist in EU-UK Trade Talks

- UK Data to Provide a Rear-View Mirror of the UK Economy

- GBP/USD Edges Towards 200DMA

The Pound posted a second consecutive weekly rise in a week which had been largely characterised by broad dollar weakness across the FX space. On the UK front, Chancellor Sunak’s Summer update was well received with markets taking a liking to plans of further spending. However, another stimulus package will likely be on the way in the Autumn.

Significant Divergences Persist in EU-UK Trade Talks

Elsewhere, EU-UK trade talks showed little signs of easing as both parties reiterated that significant divergences remained. That said, there had been some subtle signs that headway had been made over the contentious topic of fisheries. Although, it seemed as if not enough headway had been found with both parties finishing talks a day early thus confirming that the EU-UK trade negotiations remains an interminable process. As such, in light of the political headwinds that the UK faces, the outlook in the Pound remains a cautious one.

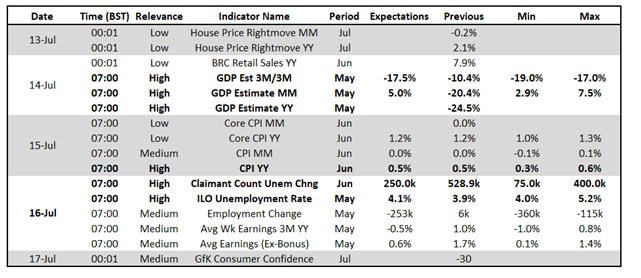

UK Data to Provide a Rear-View Mirror of the UK Economy

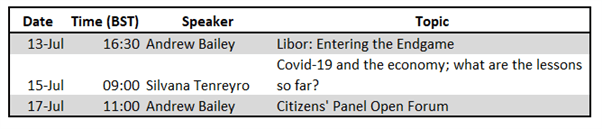

As we look to next week, UK data will be in full swing with the release of monthly GDP, inflation and employment figures. While this would normally stoke volatility in UK assets, given that the data is somewhat outdated in the current climate, we expect GBP to see a relatively muted reaction as the data provides a rear-view mirror of the UK economy. That said, in light of the upside surprises in data across the globe we see risks skewed to an upside surprise. However, do not confuse this as signs of a “V” shaped recovery. Aside from UK data, eyes will be on the BoE speakers with Silvana Tenreyro and Andrew Bailey scheduled to speak.

Bank of England Speakers

GBP/USD Edges Towards 200DMA

In light of the continued investor angst over rising Covid-19 cases, particularly in the southern states of the US. The Pound is likely to take its cue from the broader risk sentiment as opposed to domestic factors throughout the week. In turn, with GBP/USD making a firm break above 1.2600, focus is now on for a test of the 200DMA (1.2697) which will offer the first key test as to whether this latest rally will be capped. Overall, GBP/USD remains within a broad range (top at 1.28) which implied vols signal will remain the case.

Implied Weekly Range: 1.2530-1.2770

| Change in | Longs | Shorts | OI |

| Daily | -2% | -10% | -5% |

| Weekly | -19% | 33% | -3% |

GBP/USD Price Chart: Daily Time Frame

Source: DailyFX