British Pound Rate Talking Points

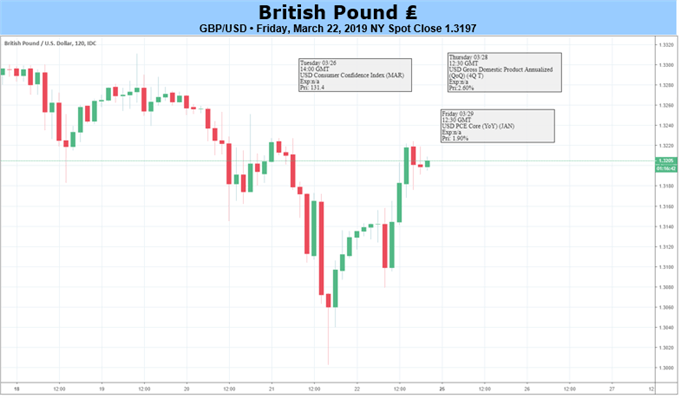

The British Pound remains battered after days of strenuous negotiations as Prime Minister Theresa May fails to secure a Brexit deal, and the GBP/USD exchange rate may exhibit a more bearish behavior over the coming days as both price and the Relative Strength Index (RSI) threaten the upwards trends from late last year.

Looking for a technical perspective on the GBP? Check out the Weekly GBP Technical Forecast.

Fundamental Forecast for British Pound: Bearish

The Brexit saga continues as the third defeat for Prime Minister May forces Parliament to lodge alternative options ahead of the April 12 deadline, with the region facing a growing risk of leaving the European Union (EU) without a deal as U.K. lawmakers struggle to meet on common ground.

The British Pound is like to face a bearish fate from a no-deal Brexit as the Bank of England (BoE) warns that ‘the economic outlook will continue to depend significantly on the nature and timing of EU withdrawal,’ but it remains to be seen if an extension will be requested as European Council President Donald Tusk plans to hold an emergency meeting on April 10. With that said, headlines surrounding Brexit may continue to influence the British Pound as the economic docket for the U.K. remains fairly light throughout the first full-week of April, but the recent pickup in British Pound volatility appears to be shaking up market participation amid a shift in retail interest.

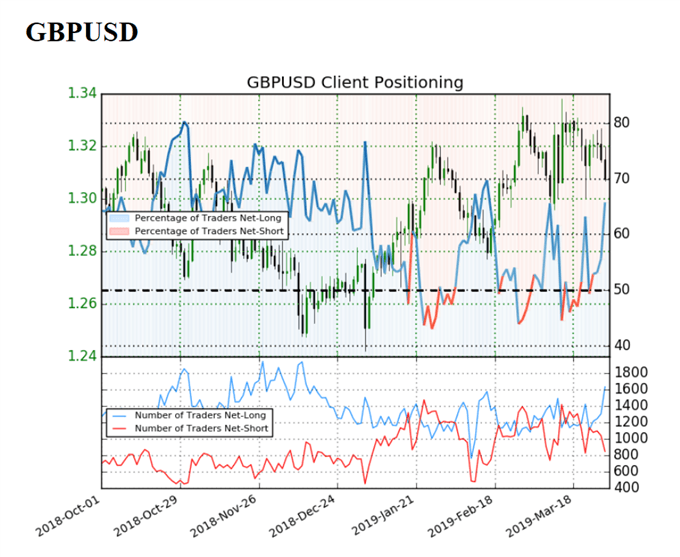

The IG Client Sentiment Report shows 65.8% of traders are net-long GBP/USD, with the ratio of traders long to short at 1.92 to 1. The percentage of traders net-long is now its highest since March 11 when GBP/USD traded back above the 1.3100 handle. The number of traders net-long is 26.5% higher than yesterday and 17.1% higher from last week, while the number of traders net-short is 28.0% lower than yesterday and 20.9% lower from last week.

The sharp decline in net-short exposure is likely a result of profit-taking behavior as GBP/USD trades to a fresh weekly-low (1.2977) on Friday, and it seems as though the retail crowd is attempting to trade the range-bound price action carried over from late-February amid the jump in net-long interest. However, a further shift in retail interest may warn of a broader change in GBP/USD behavior, with recent developments raising the risk for a further decline in the exchange rate as both price and the Relative Strength Index (RSI) snap the bullish trends from earlier this year.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

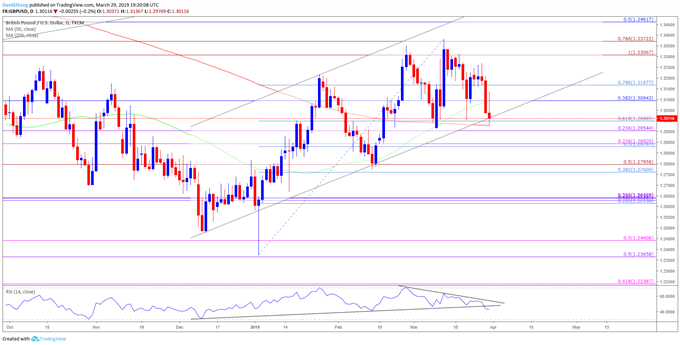

GBP/USD Rate Daily Chart

The broader outlook for GBP/USD is no longer bullish as both price and the Relative Strength Index (RSI) threaten the upwards trends from late last year, and the advance from the 2019-low (1.2373) may continue to unravel following the string of failed attempts to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

Recent series of lower highs & lows raises the risk for a further depreciation in GBP/USD, but need a break/close below the 1.2950 (23.6% retracement) to 1.3000 (61.8% retracement) area to open up the next downside hurdle around 1.2880 (50% retracement) to 1.2890 (23.6% expansion).

The 1.2760 (38.2% retracement) to 1.2800 (50% expansion) zone comes up next followed by the overlap around 1.2610 (23.6% retracement) to 1.2640 (38.2% expansion).

Additional Trading Resources

For more in-depth analysis, check out the 2Q 2019 Forecast for GBP/USD

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.

Other Weekly Fundamental Forecast:

Crude Oil Forecast – Crude Oil May be Overextended, But Watch Out For Trade Headlines