Fundamental Australian Dollar Forecast: Neutral

- AUD/USD remains very much driven by the twists of US-China trade talks

- Reserve Bank of Australia Governor Philip Lowe is due to speak

- If he underscores recent dovishness the currency could slip

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

The Australian Dollar market will find itself short of heavyweight economic events in the coming week, which will probably leave global risk appetite in charge of its fate. That appetite will in turn remain in thrall to US-China trade headlines.

There’s some lack of joined-up narrative between the two global titans now. Chinese Vice Premier Liu He proclaimed himself cautiously optimistic about reaching a ‘phase 1 deal’ which would at least temporarily cool the trade war. However, the latest wire reports on the White House’s position suggest that even an interim deal is unlikely this year, with the time table possibly sliding into 2020.

It’s possible of course that both sides are indulging in some public signaling before December 15 when a new round of tariffs is set to be imposed on Chinese goods. In any case AUD/USD like other markets has responded to both stories, slipping on apparent US reticence and rising on Chinese optimism.

Will Mr. Lowe Echo Recent Dovishness?

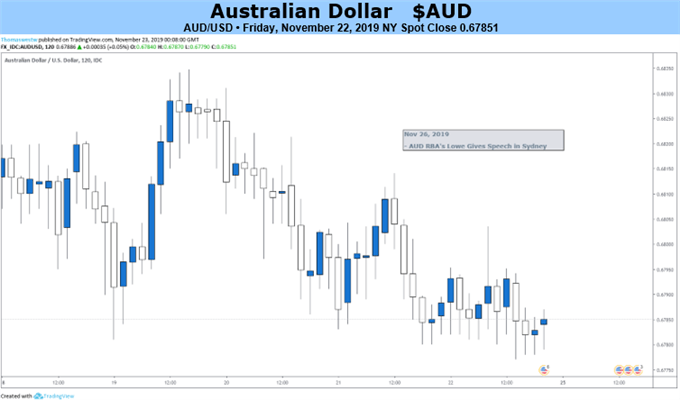

This is likely to set the pattern for the next few days, in which the most important local data point is likely to be Reserve Bank of Australia Governor Philip Lowe’s speech in Sydney on Tuesday. The RBA knocked AUD/USD on November 18. The minutes of its last monetary policy meeting suggested that a case could have been made for cutting record-low borrowing costs again earlier this month. This shocked Aussie investors who had been looking to more rate cuts next year.

Until the RBA moderates this view then its probable that all future meetings will be considered ‘live’ for the possibility of a cut. The extent to which Lowe backs it up will probably be the markets’ main focus when he speaks. If he does, the clear lack of monetary support will weigh on the Aussie whenever investors allow themselves time off from the trade story.

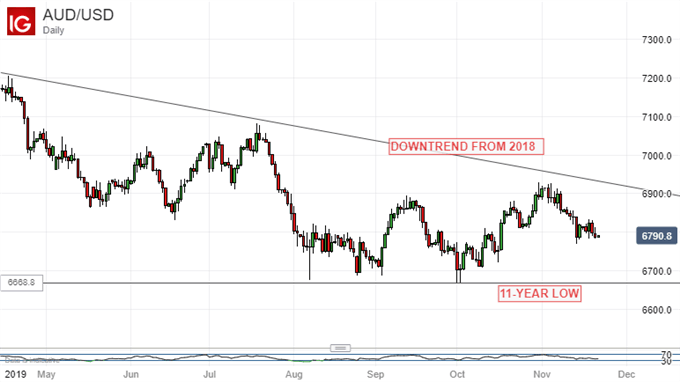

AUD/USD Daily Price Chart

However, for the moment that story is in the driving seat, and its headlines are unpredictable. It’s a neutral call this week.

Australian Dollar Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!