Crude Oil, WTI, Brent, USD/JPY, Japan, China, ECB, Lagarde - Talking Points

- Crude oil prices find support as demand continues to grow

- APAC equities were mostly softer as sentiment sours on risk assets

- All eyes on the ECB meeting. Will higher WTI feed inflation fears?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Crude oil hit a 3-month high overnight as Energy Information Administration (EIA) report showed U.S. gasoline stocks moved lower. This could showhealthy demand for the motor fuel going into the summer driving season.

Comments from UAE government minister also underpinned black gold when he said that demand from China is increasing at a time when there is little spare capacity to lift production.

The WTI futures contract is above US$ 122 bbl and the Brent contract is approaching US$ 124 bbl.

APAC equities were mostly lower after a negative lead from Wall Street overnight and US futures are soft through the after-hours session.

All Asian equity indices went lower with the exception of Japan’s Nikkei 225, that was slightly in the green. A weaker Yen helped sentiment there but soaring crude oil prices may come to bite it.

The overall mood was darkened when Shanghai locked down a district. Offsetting that, Chinese trade data for May was better than expected. It came in at US$ 78.8 billion instead of US$ 57.7 billion anticipated.

USD/JPY is trading at a 20-year high after higher energy prices spooked inflation fears. The market is fearful that if inflation re-accelerates, the Fed’s rate hike path could turn more aggressive again.

Such concerns have helped Treasury yields surge higher, with the benchmark 10-year note above 3%. Gold is steady near US$ 1,855 an ounce.

The focus for today is the ECB meeting where the market is forecasting no change to rates. The spotlight will be on President Christine Lagarde’s post decision press conference.

The degree of hawkishness will be keenly scrutinised for clues on the ECB’s hiking path. EUR/USD has been in a relatively tight range so far this week in anticipation of the meeting

Later on, the US will see some jobs data.

The full economic calendar can be viewed here.

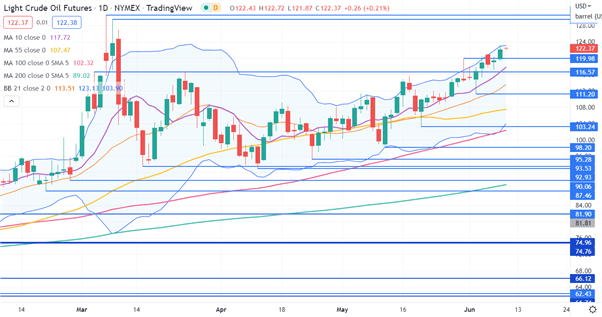

Crude Oil Technical Analysis

Bullish momentum continues to evolve for crude oil for now, as illustrated by positive gradients on all period simple moving average (SMA).

The Narch peaks at 129.44 and 130.50 might offer a resistance zone. On the downside, support may lie at a break point and a prior low at 116.57 and 111. 20 respectively.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter