British Pound, GBP/USD, US Dollar, Crude Oil, Gold, Hang Seng, LME - Talking Points

- The British Pound held ground today as Fed and BoE rate hikes loom

- APAC equities moved higher with Hong Kong leading the upswing

- All eyes are on the Fed today.Will a rate rise send GBP/USD lower?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

The British Pound has taken a breather from its downtrend in anticipation of rate hikes from both the Federal Reserve and the Bank of England in the next 2 days. The relative calm reflected the broader market taking stock ahead of the central bank meetings.

Wall Street provided APAC equity indices with a positive start and Hong Kong’s Hang Seng Tech index led the charge higher, rallying over 18% at one point.

The broader Hang Seng Index (HSI) was up over 8% at one stage. Both indices have been taking a pummelling of late and in the bigger picture, are still well down. HSI is down 32% from a year ago.

Other APAC bourses enjoyed the sunshine, with green across the board. The bounce back in sentiment help all the growth and commodity linked currencies recover some ground, notably AUD, CAD, NOK and NZD.

Commodities behaved themselves after recent volatility with Brent crude oil futures recovering from yesterday’s low of US$ 97.44 bbl to be near 102 today. Similarly, the WTI contract is around US$ 98 bbl from 93.53.

Gold remains near yesterday’s low at US$ 1,916 an ounce. After recent controversy, the nickel futures contract on the London Metals Exchange (LME) is expected back on the boards with a 5% limit on movements.

Government bonds are mostly unchanged with the benchmark US 10-year Treasury straddling 2.15% in yield.

Russian coupon payments of circa US$ 150 million are due today. Fitch - the credit rating agency - have re-iterated that if a repayment due in US Dollars is paid in Russian Ruble, it will be considered a default.

While all eyes will be on the Fed later in the day, prior to their meeting Canadian CPI will be released, as well as US retail sales and mortgage applications data.

The full economic calendar can be viewed here.

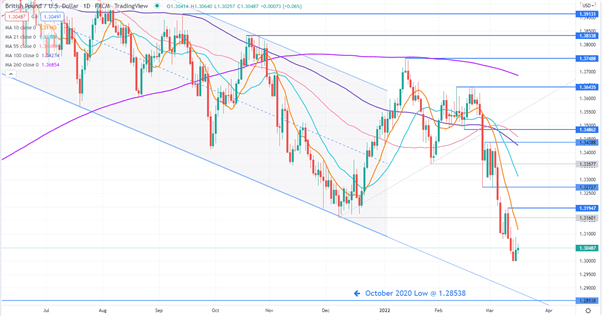

GBP/USD Technical Analysis

Despite some gains for GBP/USD in the last few sessions, it appears that there needs to be a more solid advance before bearish momentum is overcome.

The price remains notably below all short, medium and long term simple moving averages (SMA).The 10-day SMA is the nearest one and a move above it may signal near term momentum is pausing.

Resistance could be at the previous highs and pivot points of 1.31947, 1.32727, 1.34388 and 1.34862.

On the downside, support may lie at a descending trend line, currently near 1.2880 or the October 2020 low of 1.28538.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter