Dow Jones, US, China, RBA, AUD, NOK, Crude Oil - Talking Points

- The Dow Jones held ground on solid data and calm US-China talks

- APAC equities were mainly higher as sentiment remained positive

- US retail sales data expectations got a bump.Will DJI resume its uptrend?

Foundational Trading Knowledge

Understanding the Stock Market

Recommended by Daniel McCarthy

The Dow Jones Industrial Average index, and US equities generally, were pretty much unchanged overnight despite a strong read from the Empire manufacturing index reporting on sector conditions in New York state.

The index came in at 30.9 against 22 expected for November. This saw forecasts for today’s US retail sales adjusted up to 1.5% for October according to a Bloomberg survey.

The Biden-Xi summit may have helped to calm markets as the talks seemed to be positive with no concrete resolutions. The Chinese Yuan hit a 6-month high but there wasn’t much else out of it for markets.

Overnight, comments from William Dudley and Jeffery Lacker, ex Federal Reserve chiefs of New York and Richmond respectively, led to expectations for a speedier tapering rate than previously thought. The inflation danger was highlighted as an area of concern, pushing US yields higher with 10-year Treasuries hitting 1.63%.

Markets generally had a positive tone in Asia with equities nudging higher and Hong Kong’s Hang Seng Index (HSI) the outperformer thanks to casino operators doing well.

RBA Governor Philip Lowe spoke today but like a good central banker, kept to the script. No rate hikes before 2024 but the bank has previously said that they could hike in 2023 if conditions warranted it. He dismissed the chance of 2022 hike, citing inertia in wages.

In currencies, AUD and NZD lost ground as iron ore prices continued lower. The Norwegian Krone was the best performing with crude oil moving higher. Hopeful market chatter has re-emerged, looking for a release from the US Strategic Petroleum Reserve.

US retail sales data is ahead.

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Daniel McCarthy

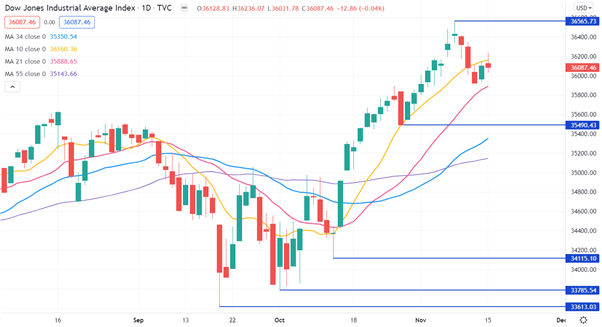

Dow Jones Industrial Average Technical Analysis

The Dow made an all-time high at 36,565.73 last week and has since pulled back to be below the 10-day simple moving average (SMA).

However, it remains above all duration SMAs including the 21, 34, 55, 100 and 200-day SMAs. This could suggest short-term bullish momentum has stalled but that medium and long-term bullish momentum might still be intact.

The 21, 34, 55, 100 and 200-day SMAs are potential support levels. The recent previous low of 35,490.43 may provide support.

On the topside, the 10-day SMA and the peak at 36,656.73 are possible resistance levels.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter