Canadian Dollar, USD/CAD, Hang Seng, Evergrande, ASX 200, RBA - Talking Points

- ASX 200 and risk assets catch a breath as the market eyes FOMC

- Evergrande casts shadow over Chinese equities ahead of bond payment

- The Canadian Dollar gains post-election. Can USD/CAD break?

The Canadian Dollar appreciated as election results started to point toward a win for the incumbent Prime Minister Justin Trudeau. It is expected that his Liberal Party will have a minority third term.

Equity markets were mixed across Asia with the Australia’s ASX 200 ending slightly positive for the day. Japan returned from a long weekend and the Nikkei 225 index played catch-up to yesterdays’ moves, down more than 2% at one stage.

Hong Kong’s Hang Seng Index remained under pressure with the Evergrande debt problems still unresolved. The Hang Seng property sub-index recovered today after several property developers refuted Reuters reports that the Chinese government is pressuring them.

The market continues to speculate about a resolution that lies somewhere between a complete meltdown or a Chinese government bail-out. The extent to how well the collapse is managed will be a focus for markets that are concerned about contagion. The Evergrande bond coupon payment is due on Thursday.

Commodity currencies found some support as risk-sensitive assets took a breather from yesterdays carnage. Crude oil moved slightly higher to help the Norwegian Krone recover yesterdays’ losses and aided the Canadian Dollar in tandem with the election result.

Iron ore prices steadied after 9 days of losses, which helped the underpin the Australian Dollar. September’s RBA meeting minutes were also released with no surprises – the path vis-à-vis the impact of the Delta variant is unclear for now, the vaccination roll-out is going well, rates are expected to remain on hold until 2024, and bond-buying will remain at A$4 billion per week until February 2022.

Looking ahead, US housing starts data is due today, but it is the FOMC meeting that looms large for markets later in the week.

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Daniel McCarthy

USD/ CAD - Technical Analysis

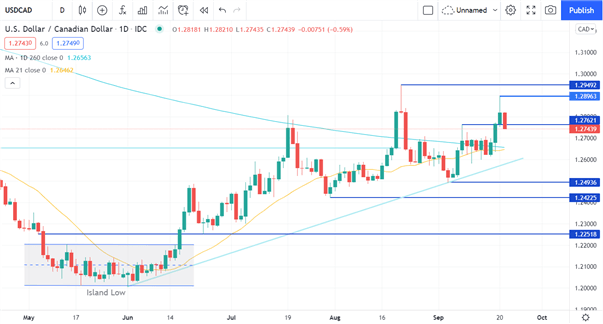

As we go to print, the USD/CAD has moved below a pivot point of 1.2762 but it will need to close below this level to suggest a potential bearish signal.

The 260-day simple moving average (SMA) at 1.2656 and the 21-day SMA at 1.2647 might provide support on approach, but a break below those levels may initiate bearish momentum.

The levels below there that could provide support are at a trend line, currently 1.2580, and potentially at previous lows of 1.2494 and at 1.2423

On the topside, possible resistance could lie at recent the highs of 1.2896 and 1,2949.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team