Euro, EUR/USD, APAC Stocks, Wall Street, Treasury Yields, ECB Minutes – European Markets Preview

- Market mood remained pessimistic during Thursday’s APAC session

- Investors are weighing improving economic growth bets versus yields

- EUR/USD eyeing ECB minutes, may be at risk to bearish ‘Death Cross’

APAC Session Recap

Market sentiment cautiously soured during Thursday’s Asia Pacific trading session, with most APAC indices trading in the red. Japan’s Nikkei 225, Hong Kong’s Hang Seng and South Korea’s KOSPI index fell. Australia’s ASX 200 was little changed. In China, the Shanghai Composite gapped higher at market open following the Lunar New Year holiday, but spent the rest of the session trimming gains.

This followed a generally mixed Wall Street trading session, where the Dow Jones gained but the tech-heavy Nasdaq Composite faltered. Investors are weighing the implications of improving economic data against the backdrop of rising longer-term Treasury yields. In the United States, retail sales and wholesale inflation surprised higher. PPI final demand gained 1.3% m/m in January versus 0.4% expected, the most since 2009.

Rising government bond rates are very slowly making it more costly to invest capital into the stock market today, requiring a higher rate of return when discounting future cash flows. Still, the FOMC minutes underscored the central bank’s dovish stance. The growth-linked Australian Dollar struggled to capitalize on a solid jobs report. Australia added 59k employed citizens in January versus 35.7k expected.

Thursday’s European Session

Looking at the economic calendar docket, the European trading session is fairly quiet A key event risk ahead will be the ECB’s account of the January monetary policy announcement. Euro traders are eyeing the central bank’s outlook for the regional bloc’s economy, including risks. There has been a notable slow start to vaccinations within member states as the region attempts to keep more infectious strains of Covid-19 at bay.

That said, ECB President Christine Lagarde did mention before that the risks to the outlook remain mostly unchanged compared to where they were in December. So if investors are more anxious than the central bank is perceived, the Euro may benefit here. But, EUR/USD may focus on other key themes such as the fundamental forces driving longer-term government bond yields higher, giving the Greenback an advantage.

Check out the DailyFX Economic Calendar for more key event risks!

Euro Technical Analysis

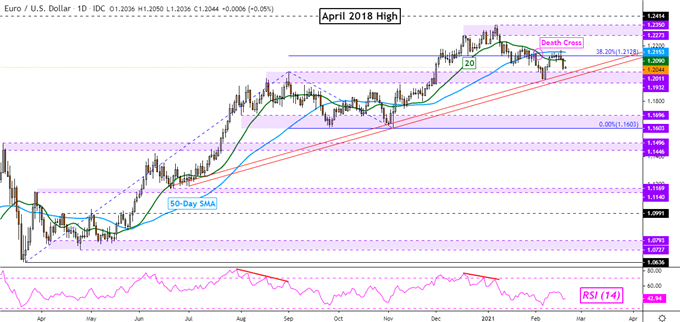

EUR/USD is looking at key rising support from June, highlighted on the daily chart below. This is as prices are approaching the 1.1932 – 1.2011 inflection zone again. A bearish ‘Death Cross’ is hinting that further losses may be ahead after the 50-day Simple Moving Average crossed above the 20-day one. A push above these lines would expose the 1.2273 – 1.2350 resistance zone, just under the April 2018 high.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

EUR/USD Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter