Canadian Dollar, Fiscal Support, Coronavirus Vaccines, USD/CAD, IGCS – Talking Points:

- Equity markets traded broadly mixed during APAC trade as investors turned their focus to the upcoming US Senate run-off elections in Georgia.

- Substantial fiscal support and buoyant consumer confidence may underpin the Canadian Dollar against the Greenback in the near term.

- USD/CAD eyeing a push to fresh yearly lows as prices continue to track within a bearish Descending Channel.

Asia-Pacific Recap

It proved to be a mixed day of trade for equity markets as traders mulled global coronavirus developments and turned their attention to the upcoming US Senate run-off elections in Georgia.

Australia’s ASX 200 index slipped marginally lower while Japan’s Nikkei 225 fell 0.37%. China’s CSI 300 index surged 1.91% as market participants cheered the decision by the New York Stock Exchange not to delist three Chinese telecom companies.

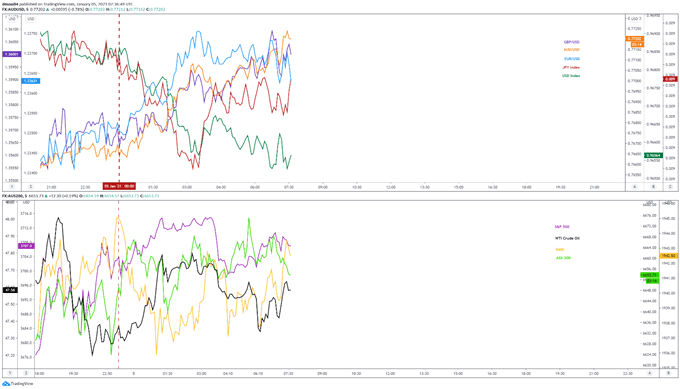

In FX markets, the cyclically-sensitive AUD and NZD largely outperformed, while the haven-associated USD and JPY lost ground against their major counterparts. Gold and silver crept higher despite yields on US 10-year Treasuries nudging up 1 basis point.

Looking ahead, German employment data headlines the economic docket alongside Canadian PPI and ISM manufacturing figures out of the US.

Market reaction chart created using Tradingview

Buoyant Consumer Confidence to Underpin CAD

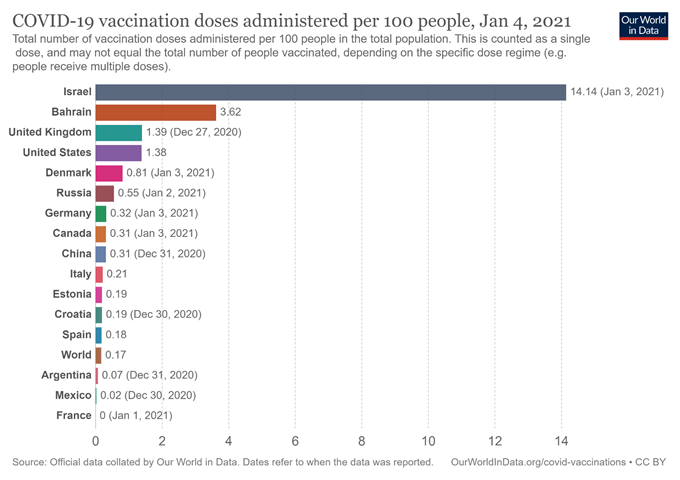

As mentioned in previous reports, the Canadian Dollar may gain ground against its US Dollar counterpart on the back of strong government support and the nation’s gradual distribution of Pfizer’s coronavirus vaccine.

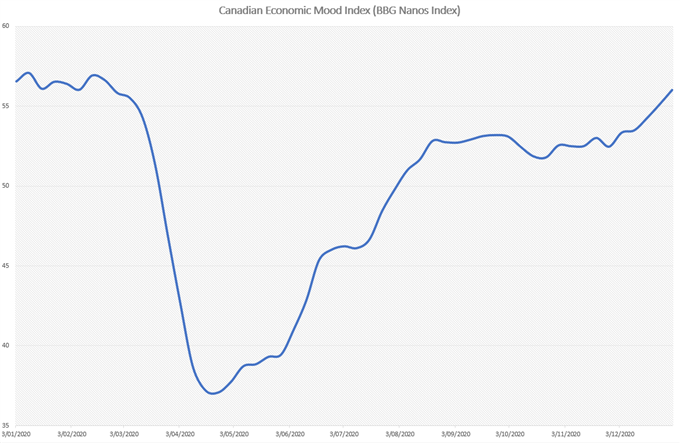

Although Covid-19 cases have continued to surge locally, forcing several Canadian provinces to tighten restrictions, robust fiscal support has seen consumer confidence surge back to pre-pandemic levels for the first time.

Finance Minister Chrystia Freeland unveiled over C$51.7 billion of additional fiscal aid at the end of November, with the measures including an enhanced wage subsidy program – expected to cover up to 75% of payroll costs – and the extension of commercial rent and lockdown support.

Source – Bloomberg

Freeland stated that “our government will make carefully judged, targeted and meaningful investments to create jobs and boost growth, [and] will provide the fiscal support the Canadian economy needs to operate at its full capacity and to stop Covid-19 from doing long-term damage to our economic potential”.

That being said, the relatively slow rate of vaccinations may weigh on investor sentiment in the near term, as Canada struggles to deal with the logistical hurdles associated with distribution.

Nevertheless, a significant fiscal safety net, in tandem with better-than-expected economic data, may continue to put a premium on the cyclically-sensitive currency.

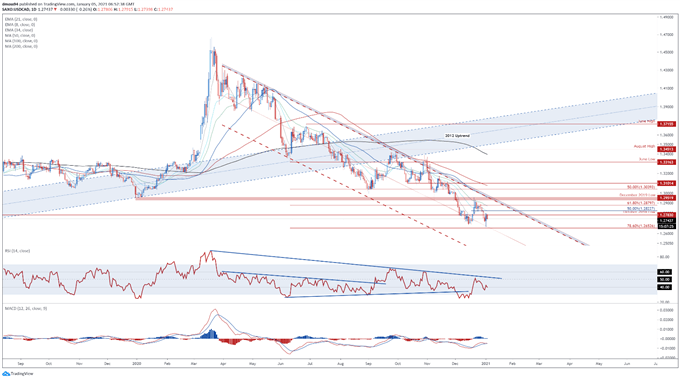

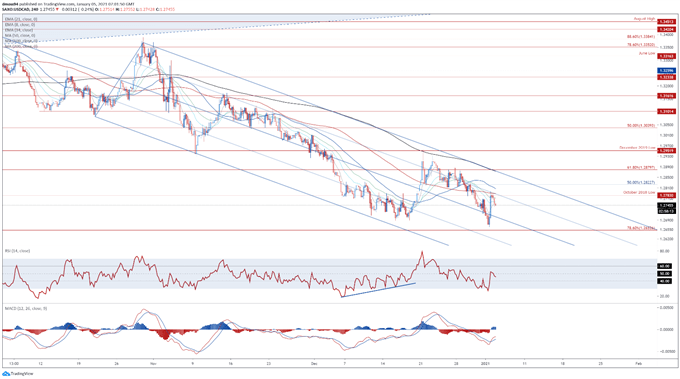

USD/CAD Daily Chart – Descending Channel Guiding Price Lower

The technical outlook for USD/CAD rates remains skewed to the downside, as prices continue to track within the confines of a Descending Channel.

Bearish moving average stacking, in tandem with both the RSI and MACD indicator travelling below their respective neutral midpoints, suggests the path of least resistance is lower.

A retest of the monthly low (1.2665) looks likely if confluent resistance at the 8-day exponential moving average and October 2018 low (1.2783) remains intact.

Clearing that probably signals the resumption of the primary downtrend and brings psychological support at 1.2600 into focus.

Alternatively, a daily close back above 1.2785 could neutralize near-term selling pressure and generate a rebound towards the 21-EMA (1.2860).

USD/CAD daily chart created using Tradingview

USD/CAD 4-Hour Chart – 100-MA Capping Upside

Zooming into a four-hour chart bolsters the bearish outlook depicted on the daily timeframe, as prices fail to hurdle confluent resistance at the Pitchfork parallel and 100-MA (1.2790).

With the trend-defining 50-MA gearing up to cross back below the 100-MA, and the RSI struggling to hold above 50, further losses appear in the offing.

Pushing back below the 8-EMA (1.2749) would probably open the door for sellers to challenge the psychologically imposing 1.2700 mark, with a convincing push below likely precipitating a retest of the monthly low (1.2665).

On the contrary, holding constructively above 1.2750 could allow buyers to drive prices back towards psychological resistance at 1.2800. Hurdling that would bring the 50% Fibonacci (1.2823) into the crosshairs.

USD/CAD 4-hour chart created using Tradingview

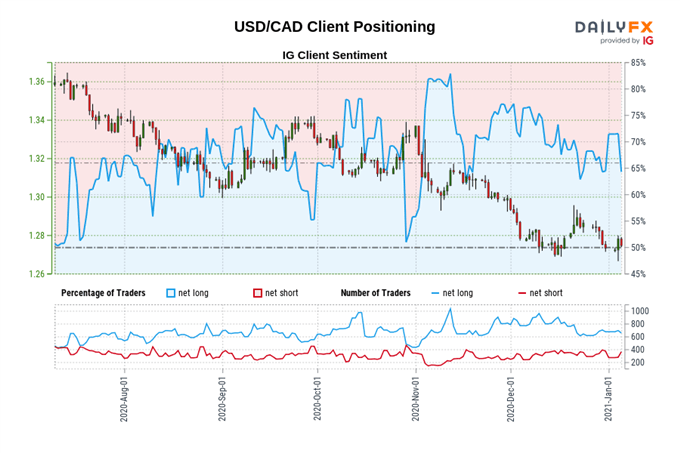

IG Client Sentiment Report

The IG Client Sentiment Report shows 61.17% of traders are net-long with the ratio of traders long to short at 1.58 to 1. The number of traders net-long is 12.06% lower than yesterday and 6.14% lower from last week, while the number of traders net-short is 37.24% higher than yesterday and 13.39% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss