USD/JPY, FOMC Economic Projections, Federal Reserve Rate Decision, Inflation Expectations – Talking Points:

- Risk-sensitive assets broadly outperformed their haven-associated counterparts throughout Asia-Pacific trade.

- The upcoming FOMC interest rate decision could define the US Dollar’s medium-term outlook.

- USD/JPY rates poised to move lower after failing to climb back above pivotal chart resistance.

Asia-Pacific Recap

Equity markets gained during Asia-Pacific trade, with Australia’s ASX 200 index storming 1.04% higher on the back of the Westpac Leading Economic Index’s largest month-over-month rise since September 1997.

The haven-associated Japanese Yen and US Dollar lost ground against their major counterparts while the risk-sensitive Australian Dollar held steady above the 0.73 level.

Gold and silver nudged higher as yields on US 10-year Treasuries slid marginally lower.

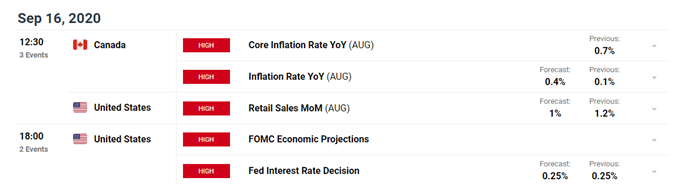

Looking ahead, the eyes of the investing world will be intently focused on the Federal Reserve’s upcoming interest rate decision, with US policymakers expected to elaborate on the changes made to the central bank’s monetary policy framework.

FOMC Rate Decision Could Ignite USD/JPY Downtrend

The upcoming Federal Open Market Committee (FOMC) meeting will likely define the outlook for the haven-associated US Dollar, with the central bank expected to provide its updated Summary of Economic Projections (SEP) and show how it will implement its recent adoption of average inflation targeting (AIT).

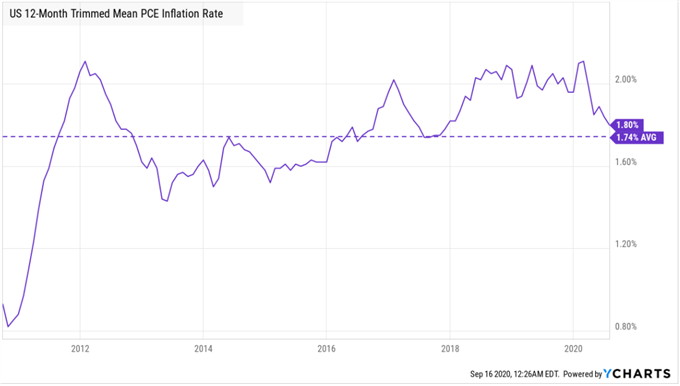

Average inflation targeting essentially allows the FOMC to extend accommodative monetary policy measures following periods of below-target price increases to “achieve inflation moderately above 2 percent for some time”.

Therefore, given the Fed’s preferred measure of price growth has consistently fallen short of the previously mandated 2% target since its implementation 8 years ago, and 5-year inflation expectations are currently hovering at 1.54%, record low interest rates appear here to stay for the foreseeable future.

Having said that, the provision of additional stimulus, outside of forward guidance, seems relatively unlikely despite the lack of progress in Congressional stimulus talks and a Covid-19 death toll in excess of 200,00.

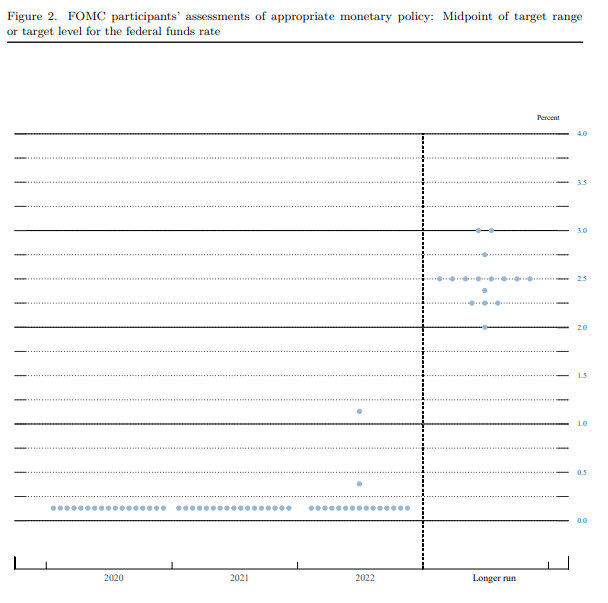

With that in mind, the fundamental change to the Fed’s monetary policy framework is likely to be reflected in the interest rate dotplot supplied in the updated SEP release, with a notable lowering of rate expectations in the “longer run” probably buoying risk-associated assets and hampering the performance of the Greenback. The interest rate dotplot for June showed that most US policymakers believe that the Fed Funs rate will normalize at 2.5% post-2022.

To that end, further clarification of the Federal Reserve’s updated framework could underpin risk-associated assets and in turn result in a marked discounting of the haven-associated US Dollar against its major counterparts.

Source – Federal Reserve

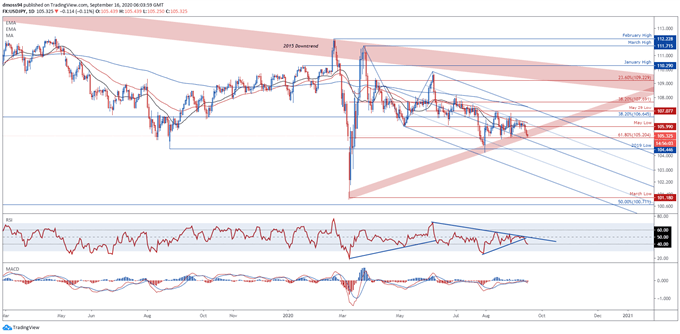

USD/JPY Daily Chart – Schiff Pitchfork Guiding Price Lower

From a technical perspective, USD/JPY rates look poised to extend their trek lower after failing to climb back above confluent resistance at the trend-defining 50-day moving average (106.23) and Schiff Pitchfork parallel.

A push to fresh monthly lows looks in the offing, as the RSI and MACD indicators slide below their respective midpoints and price continues to track below the 21-, 50- and 200-day moving averages.

A daily close beneath confluent support at 61.8% Fibonacci (105.20) and the uptrend extending from the March low (101.18) would probably validate bearish potential and carve a path for price to test the 2019 low (104.45) and psychologically pivotal 104.00 level.

On the other hand, should support at the 61.8% Fibonacci (105.20) remain intact a short-term recovery to retest the monthly high (106.55) could eventuate, with a break back above the 38.2% Fibonacci (106.64) needed to bring the sentiment-defining 200-DMA (107.38) into play.

USD/JPY daily chart created using TradingView

| Change in | Longs | Shorts | OI |

| Daily | -2% | 2% | 0% |

| Weekly | 12% | -16% | -6% |

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss