EUR/USD, GBP/USD, USD/CAD, Europe Open – Talking Points:

- Canada’s downgraded credit rating may fuel further upside for USD/CAD

- EUR/USD plunged after US announced the possibility of new tariffs on EU exports

- GBP/USD bearish engulfing at key resistance could spell further downside

Asia-Pacific Recap

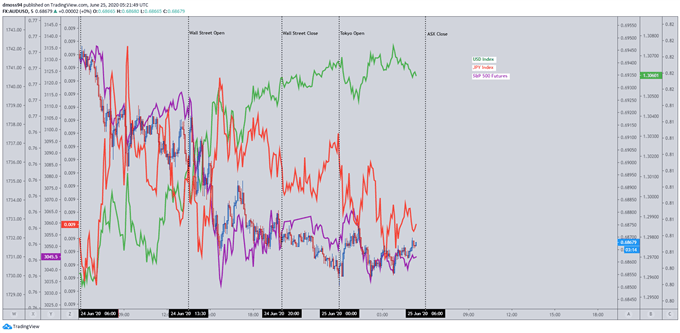

Equity markets sank during Asia-Pacific trade as coronavirus concerns, escalating geopolitical tensions and a downgraded global growth forecast from the International Monetary Fund (IMF) soured investor sentiment.

The return of risk aversion saw S&P 500 futures decline alongside the ASX 200, as Australian Covid-19 cases spiked to the highest number since April, with the local currency following the benchmark index lower.

The US Dollar shot higher against its North American counterpart, as Canada’s credit rating was downgraded in response to the recent surge in government debt.

Looking forward, US durable goods orders and first quarter GDP growth data headline the economic docket, with worse-than-expected figures possibly intensifying the risk averse response seen over the last week of trade.

Source - TradingView

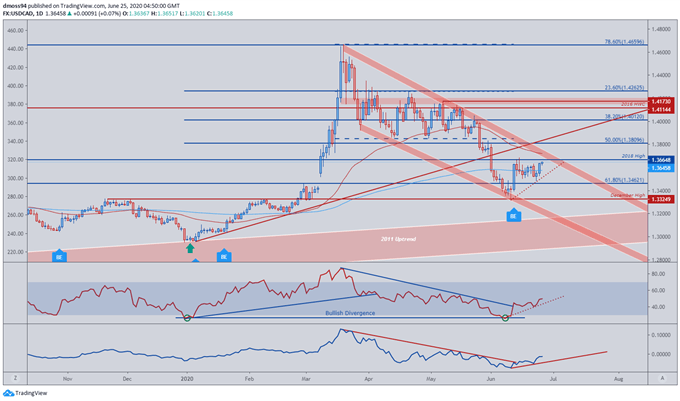

USD/CAD – AAA Rating Downgrade from Fitch Fuels Rally

The US Dollar may continue to recover against its North American counterpart, fuelled by the recent surge in risk aversion and a one notch downgrade to Canada’s AAA credit rating.

Citing the spike in emergency spending “to counteract a sharp fall in output”, ratings agency Fitch expects government debt to GDP to surge from 88.3% last year to 115% in 2020, “as parts of the economy were shuttered to contain the spread of the coronavirus”

The USD/CAD exchange rate moved higher off the news, slicing through resistance at the 200-day moving average (1.3578) to test the 2018 high (1.3665).

Despite remaining contained within a descending channel, technical indicators suggest a move higher may be on the cards, with bullish divergence on the RSI reinforced by the recovery of the momentum indicator from the yearly extremes.

Convergence of the 50-MA (1.3720) and channel resistance remains a significant hurdle for buyers to overcome. A close above this pivotal resistance level could signal a resumption of the primary uptrend, with key regions of interest falling at the 1.38-handle and 50% Fibonacci (1.3810).

Source - TradingView

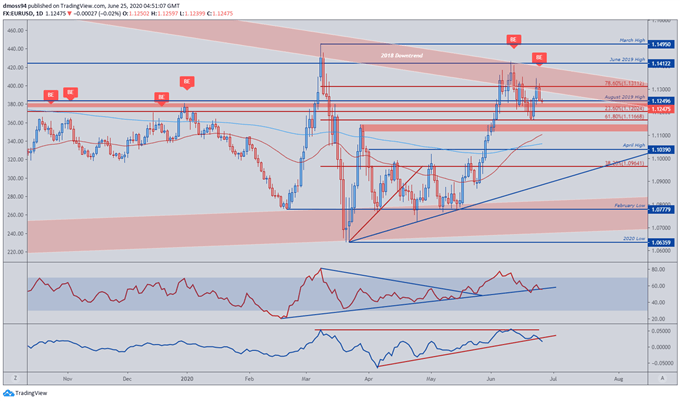

EUR/USD – Euro at the Mercy of US-Trade Negotiations

EUR/USD plunged after US President Donald Trump announced the possible imposition of $3.1 billion new tariffs on exports from the European Union, as trade negotiations between two of the world’s largest economies continues to stall.

A formation of a Bearish Engulfing candle at the pivotal 78.6% Fibonacci (1.1312) underscores the downward pressure escalating geopolitical tensions could have on the proxy for global growth, as price retreated to support at the January high (1.1240).

Despite this steep decline EUR/USD continues to track within a potential Bull Flag continuation pattern, as price remains constructive above key support at the 61.8% Fibonacci (1.1167).

However, technical studies suggest that further downside could be on the horizon, with both the RSI and momentum indicators snapping their respective uptrends.

Selling pressure may intensify should price clear support at the 61.8% Fibonacci (1.1167), possibly carving a path for a decline back to the 200-day moving average (1.1065) and April high (1.1039).

Source - TradingView

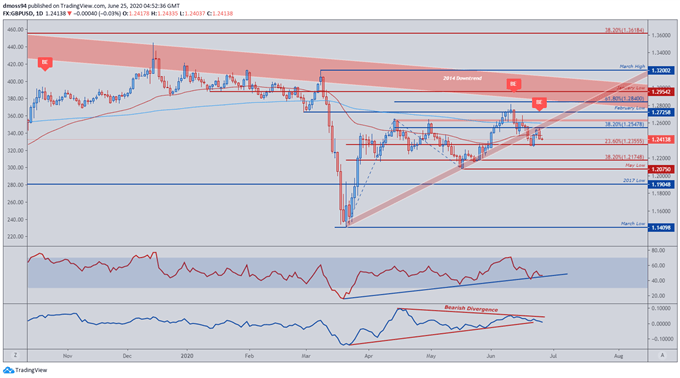

GBP/USD – Bullish Engulfing Hints at Further Downside

After slicing through its 12-week uptrend earlier this week, GBP/USD looks poised for further downside, after the formation of a Bearish Engulfing candle at 38.2% Fibonacci resistance (1.2548).

Failure to hold above the 50-day moving average (1.2460) suggests a push back to the May low (1.2075) may be on the cards if sellers can overcome initial support at the 23.6% Fibonacci (1.2355) and June low (1.2320).

Selling pressure may intensify should the RSI snap its constructive 3-month trend, with the momentum indicator suggesting increasing bearish bias as it continues to strengthen to the downside.

Source – TradingView

-- Written by Daniel Moss

Follow me on Twitter @DanielGMoss