Europe Open, BoE, ECB, GBP/USD, Monetary Policy Talking Points:

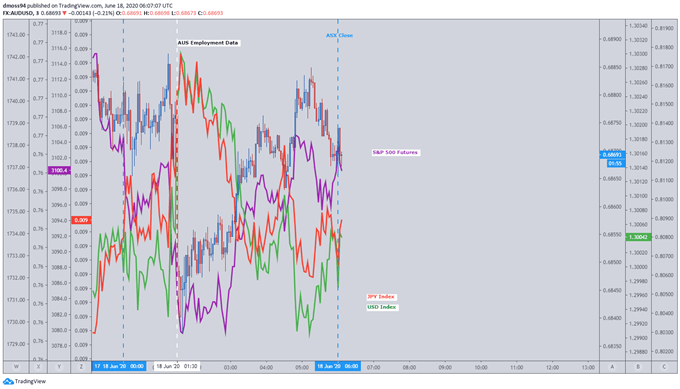

- The Australian Dollar dragged risk assets with it, plunging as the local unemployment rate spiked to a 19-year high

- Bank of England expected to expand asset purchasing facility at upcoming meeting

- GBP/USD treading water ahead of BoE meeting. Will downside bias follow through?

Asia-Pacific Recap

Early risk aversion faded as Asia-Pacific trade developed with the Australian Dollar plunging after the local unemployment rate rose to a 19-year high.

S&P 500 futures followed the risk-sensitive currency lower as the haven-linked US Dollar and Japanese Yen climbed against their major counterparts.

Swelling virus concerns continue to hamper risk assets as the hospitalization rate in Texas surged to 11% and the outbreak in Beijing sees containment measures escalate.

Looking forward, the Bank of England and Swiss National Bank policy decisions headline the economic docket with both central banks expected to keep benchmark interest rates on hold.

Source – Trading View

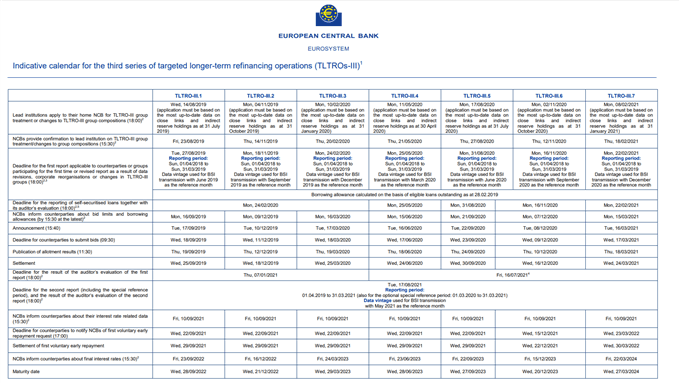

ECB TLTRO III Could Define Risk Appetite

The European Central Bank’s targeted longer-term refinancing operations (TLTRO) for June could define market risk appetite and provide an assessment of the current health of the interbank lending system.

TLTRO III was introduced by the ECB to “materially reduce the potentially adverse impact of tightening market-based funding conditions on lending to firms and households” through the provision of short-term three-month loans.

Isabel Schnabel, ECB executive board member responsible for market operations, forecasts an overall uptake of €1.4 trillion for the program, which may provide a baseline for investors attempting to assess the effectiveness of one of the central bank’s primary monetary policy weapons.

Demand in line with this figure may stimulate appetite for risk and confirm the operation’s viability in continuing to support credit markets, as a “cautious recovery in activity is currently taking place”.

Source – European Central Bank (ECB)

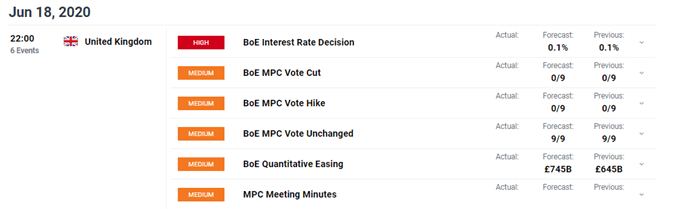

Bank of England Rate Decision on Tap

The Bank of England is expected to keep the key bank rate at the record low of 0.1%, despite the suggestion that the central bank may be contemplating the implementation of a negative interest rate policy (NIRP).

With Governor Andrew Bailey and his counterparts voting unanimously to leave the benchmark interest rate untouched at their most recent meeting in May, it seems unlikely that the BoE will start their journey down the negative rates path in the short-term.

However, with consumer price inflation (CPI) falling to its lowest rate since June 2016, an announcement of a top-up to the £645 billion Asset Purchase Facility (AFP) is expected by market participants. Two members voting for an additional £100 billion increase last month provide a ball-park figure on the possible expansion.

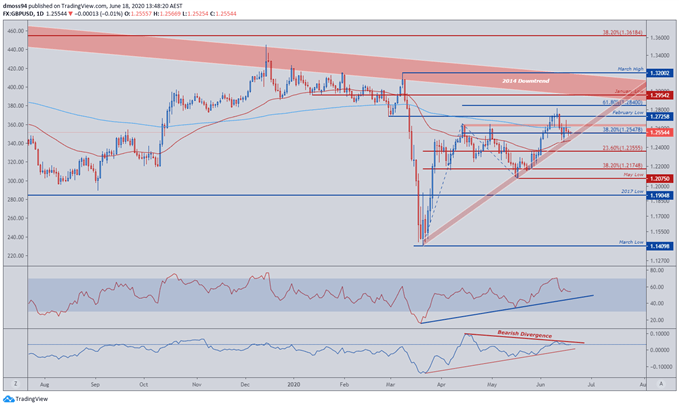

GBP/USD has remained confined within a tight trading range, bouncing between 50-MA support (1.2465) and 200-MA resistance (1.2610), as investors look to the upcoming Bank of England rate decision for future direction.

Downside bias lingers as the momentum indicator fails to follow price to fresh highs, suggesting the British Pound may continue its recent decline against its US Dollar counterpart.

The inability for price to sustain its push above the April high (1.2648) reinforces the weakness seen in technical indicators, as the RSI swiftly retreated just shy of registering its first overbought readings since December 2019.

Convergence of the 50-MA (1.2465), with the uptrend from the March low (1.1410), may provide a supportive base for price to push back to test monthly high (1.2813), if buyers are able to overcome resistance at the 200-MA (1.2610) and April high (1.2648).

However, a daily close below trend support and the 50-MA (1.2465) may signal the resumption of the long-term downtrend, possibly carving for GBP/USD to test the 38.2% Fibonacci (1.2175) and May low (1.2075).

GBP/USD Daily Price Chart

Source – Trading View

-- Written by Daniel Moss

Follow me on Twitter @DanielGMoss