Euro Outlook, Eurozone Finance Minister Meeting, Coronavirus – Talking Points

- Euro at risk as political feud between North and South pressure regional growth prospects

- Policymakers continue to debate on best course of action to combat coronavirus pandemic

- EUR/USD is still range-bound but narrowing compression zone may reveal directional bias

Euro at Risk as Political Divide Threatens Regional Growth, Coordinated Policy

The Euro continues to suffer as typically fiscally-conservative officials from the North and their otherwise-inclined Southern counterparts bicker about a unified approach to address the economic impact of the coronavirus. A meeting on Thursday failed to yield meaningful results after a conference last week also ended with officials sticking to their positions. The debt-mutualizing “corona-bond” proposal continues to be the main point of contention.

The friction is nothing new, but the urgency of the talks under the current economic conditions is unprecedented as the Eurozone faces the prospect of a deeper recession than it endured ten years ago. While Brussels has loosened the purse strings to allow more governments to deficit spend, the issue over additional aid and use of the crisis-era Emergency Stability Mechanism (ESM) is pressuring the Euro.

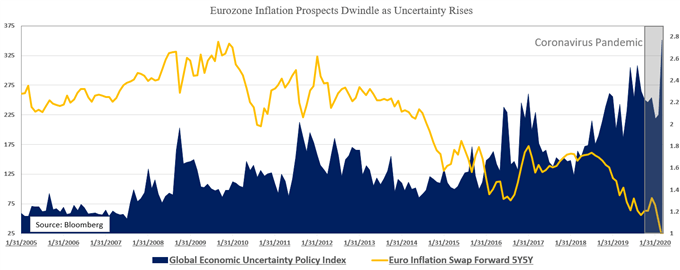

This is because the impact of the virus-induced slowdown is anticipated to be so large that it would require a proportional stimulus response to mitigate the depth and severity of a recession. Regional inflation expectations continue to look grim as global uncertainty rises amid the coronavirus pandemic. Without a coordinated policy effort, the forecasts are likely to become gloomier.

EUR/USD Analysis

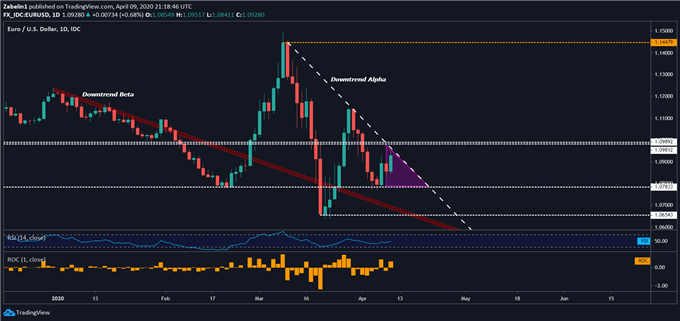

EUR/USD recently flirted with the descending resistance (labelled as “Downtrend Alpha”) within the compression zone, potentially setting the pair up for a retest of support at 1.0783. A downside breakout would reinforce the fundamental notion of a bearish overhang haunting the Euro as the region faces the prospect of an unprecedented recession. Breaking below support at 1.0783 may open the door to retesting “Downtrend Beta”.

EUR/USD – Daily chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter