US Dollar Analysis, EUR/USD, US and Eurozone PMI Data on Deck – Talking Points

- US Dollar could rise on haven-demand if NFP and ISM reports underwhelm

- Euro may face liquidation pressure after final PMI data for March is released

- EUR/USD selloff could accelerate after pair broke below a key support range

Asia-Pacific Recap

US equity futures pointed lower during Friday’s Asia Pacific trading session while APAC stock markets were generally mixed. Foreign exchange markets were relatively quiet even after Chinese Caixin services and composite PMI data came in at 43.0 and 47.6, respectively. This is significantly higher than the prior 26.5 and 27.5 prints that marked the lowest figures on record.

US NFP Data

The US Dollar may rise versus the Euro and its G10 peers if nonfarm payrolls data for March print a worse-than-expected estimate than the already-low forecast of -100k. This follows yesterday’s release of jobless claims data that registered another all-time high at 6.48 million, beating the prior record of 3.28m. A sour reading could tilt markets to favoring assets with greater liquidity over their higher-yielding, riskier counterparts.

The unemployment rate is anticipated to tick up to 3.8 percent from the prior 3.5 percent reading, though given the magnitude of recent job losses, this number could fall short of the actual data. This is as US final Markit PMI data for March is expected to show a 38.5 print for services and a 43.0 figure for non-manufacturing. While their capacity to move markets individually may be low, a poor reading – along with NFPs – could collectively sour sentiment and push the US Dollar higher.

EUR/USD Analysis

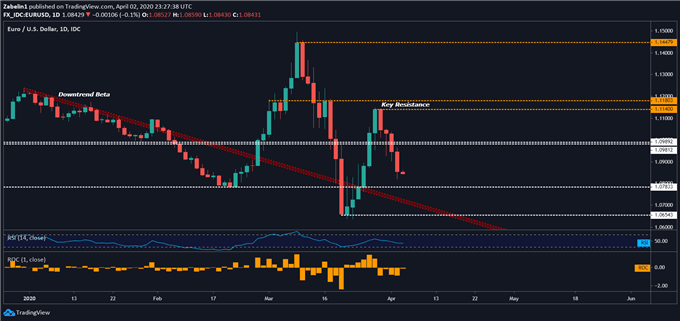

EUR/USD confirmed a daily close below the trend-defining 1.0989-1.0981 support range and may now retest the floor at 1.0783. Cracking support there would open the door to retesting the inflection trend (labelled as “Downtrend Beta”). Trading below this steep slope of appreciation would likely reinforce the bearish overhang haunting EUR/USD.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

US DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter