EURO, EUR/USD, ECB, Coronavirus, Eurozone Economy – Talking Points

- Euro outlook bearish as EU governments initiate lockdowns

- US equity futures hit limit down five minutes into APAC open

- EUR/USD could attempt to challenge three-month resistance

ASIA-PACIFIC RECAP

Early into Asia’s trading session, US stock futures fell 5 percent, triggering the “limit down” circuit-breaker stopping trade less than 10 minutes into the market open. The New Zealand Dollar plunged against its major counterparts after the RBNZ announced an NZ$30 billion “large scale asset purchase program” to combat the impact of the coronavirus. The petroleum-linked Norwegian Krone fell the hardest and is the worst-performing G10 currency year-to-date.

Europe on Lockdown as Virus Contagion Threatens Regional Growth

The Euro may continue to slide against the US Dollar if the spread and impact of the coronavirus continues to lower the growth outlook. As of this moment, the total number of confirmed Covid-19 cases stands at approximately 335,000 with the vast majority in mainland China. Italy is in second place however, registering more deaths from the virus than where it had originated.

In addition to shutting down travel to the regional bloc for non-EU citizens, Italy – the third largest Eurozone economy – has also restricted internal travel. Furthermore, the spread of the virus to key policymakers may begin to unnerve markets even more. German Chancellor Angela Merkel is now in quarantine in her home after she had contact with an infected doctor.

If investors start seeing leaders falling prey to the virus, it could inspire further liquidation. This may be out of a fear that incapacitated policymakers could delay the effective and timely implementation of much-needed stimulatory measures. As far as markets have seen this has not been the case – at least not yet.

While over the past few weeks markets have generally tended to focus more on fundamental developments than economic indicators, key statistics have managed to elicit cross-asset volatility. German data in particular tends to inspire moves in the Euro. In the upcoming session, a preliminary look at Eurozone consumer confidence for March is expected to show a -13 reading.

If the data registers at that print, it would mark the softest reading since the Eurozone debt crisis. However, given last week’s IFO and ZEW data, it would not be surprising to see these statistics fall in line with the former’s performance. This comes as officials in Brussels warned that a recession that will likely occur in 2020 could be comparable to what investors saw over a decade ago.

EUR/USD TECHNICAL ANALYSIS

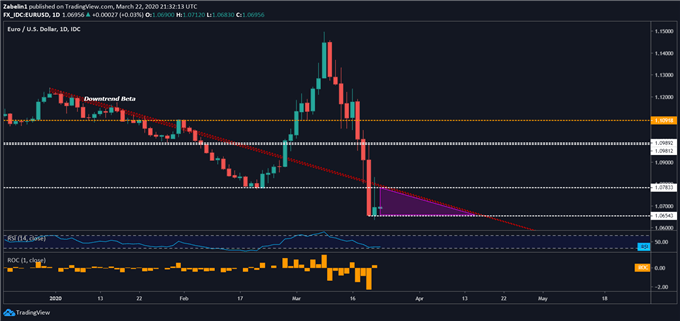

Last week, EUR/USD crashed through support at 1.0783 and is now trading below a familiar descending resistance line dating back to December 31, 2019. The pair appears to be showing some signs of bottoming at 1.0654. It may bounce between that floor and the remaining area between it and the slanted ceiling before committing to an upside or downside breakout.

However, if the pair manages to clear the steep slope of depreciation, former support turned resistance at 1.0783 could cap EUR/USD’s gains. Conversely, a break lower could accelerate liquidation and cast a bearish overhang as the pair edges closer to retesting a four-year low. To get more updates on EUR/USD, be sure to follow me on Twitter @ZabelinDimitri.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter