US Dollar, FOMC, Gold Prices – Talking Points

- US Dollar may rise if Fed outlook cools 2020 rate cut bets despite trade war

- Why Jerome Powell will likely cite corporate debt as growing a financial risk

- FOMC rate decision, outlook may catalyze downside breakout in XAU/USD

Learn how to use politicalrisk analysis in your trading strategy !

The US Dollar may rise at the expense of gold prices if the FOMC rate decision and outlook placates 2020 Fed rate cut bets. If officials feel the need for additional easing is not as urgent, demand for anti-fiat hedges like gold may fall and drag XAU/USD with it. At his most recent press conference, Fed Chairman Jerome Powell said that unless economic conditions “materially” change, an adjustment in rates is not required.

US Dollar Outlook Bullish Ahead of FOMC

The US Dollar may get a boost from optimistic Fed officials who may see the prevailing economic conditions as not warranting additional stimulus. Their view will likely be buttressed by last week’s publication of impressive employment data that saw the creation of 266k jobs, beating the 180k estimate. While services remain strong, the industrial sector continues to be afflicted by prolonged US-China trade war negotiations.

However, if relations between Beijing and Washington continue to worsen, it could inflame 2020 rate cut bets and pressure the US Dollar. Up until recently, the Greenback was climbing despite mounting easing expectations as investors horded USD amid eroding fundamentals and a pessimistic outlook for growth. But recently, US Dollar price dynamics changed and its appeal as an anti-risk asset shifted to something else.

The attraction of owning the now Greenback amid a buoyant environment comes from the high yield it carries relative to it other G10 counterparts. Now, when fundamental developments emerge that could tilt the Fed to be more dovish, the Greenback has typically contracted. However, if the financial zeitgeist shifts from cautious optimism to doom and gloom, markets could see USD’s anti-risk attraction get triggered and rise despite a surge in easing bets.

USD Dollar Index vs EUR, JPY, GBP and AUD Rising Despite Fed Rate Cut Bets Throughout 2019

US Dollar index chart created using TradingView

Why Powell May Stress Corporate Debt as a Major Risk

Mr. Powell, along with a plethora of other policymakers around the world have started to stress with increasing urgency the potential risks behind rising levels of corporate debt in non-financial institutions. More specifically, the explosion of the leveraged loan market. Their securitization into so-called CLOs has given officials a traumatic memory of a familiar risk that rocked the global financial system a decade ago.

How Might CPI Data Impact USD?

Inflation continues to lag below the Fed’s 2 percent target in part due to the disinflationary nature of the US-China trade war. However, on a year-on-year basis, price growth is now expected to clock in at 2.0 percent, slightly higher than the prior 1.8 percent figure. The impact of the data could end up being overshadowed by the FOMC rate decision and outlook since the latter carries a higher premium in market attention.

Gold Price Forecast Bearish if Fed Strikes Optimistic Tone

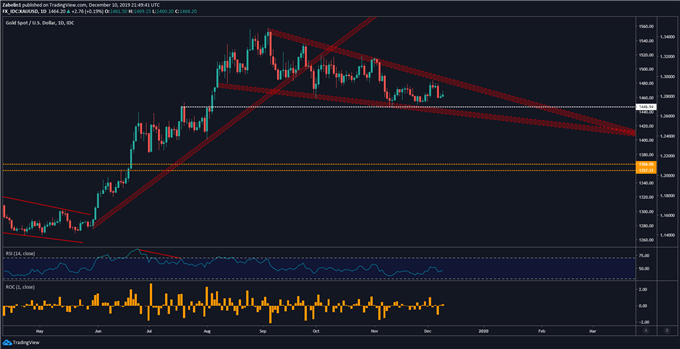

XAU/USD may extend its decline and continue to trade below the descending resistance channel if gold traders believe further easing in 2020 may not come as soon – or as aggressively – as expected. Looking ahead, traders will be closely eyeing support at $1446.94, which if broken could catalyze a downside breakout. Conversely, if policymakers radiate unexpectedly dovish undertones, XAU/USD may flirt with resistance.

Gold Prices – Daily Chart

XAU/USD chart created using TradingView

US DOLLAR TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter