US Economic Data, US Dollar Outlook

- US Dollar, stock markets may suffer if US ISM composite data misses estimates

- US equities remain vulnerable after key local data fueled aggressive risk-off tilt

- WTO ruling tilted in favor of US – Washington to impose tariffs against the EU

Learn how to use political-risk analysis in your trading strategy !

The US Dollar along with local and European equity markets may suffer if yesterday’s aggressive selloff extends into the session against the backdrop of deteriorating EU-US trade relations. The WTO recently announced a final ruling on a 15-year dispute that awards the US the right to impose tariffs of up to $7.5 billion worth of EU goods. This comes amid the US-China trade conflict and rising geopolitical risks.

In the US, ISM composite data is expected to show a 55.1 print, slightly less than the previous 56.4 reading. Local factory orders data is expected to show a 0.2 percent contraction, significantly lower than the prior 1.4 percent increase. Data out of the US has significantly improved over the past few months, though recent gloomy results put that recovery at risk, especially in light of the EU-US trade conflict.

The WTO recently gave its final ruling on a 15-year dispute over Europe subsidizing aircraft giant Airbus and has awarded the US the right to impose over $7 billion worth of tariffs on EU goods. On October 18, the US will levy a 10 percent tariff on commercial aircrafts and a 25% tax on various agricultural and industrial goods. Europe will not be able to retaliate yet, though Washington may impose additional tariffs on security grounds.

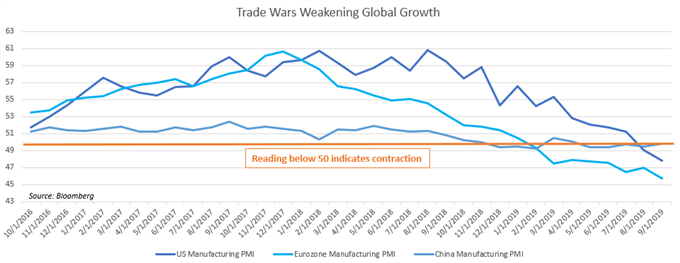

Policymakers have continued to cite strained international trade tensions as a primary factor behind slower growth and softer cross-border investment. Weaker business confidence is a reflection that producers are hesitant to expand production if the demand to purchase their products is lacking. Waning consumer confidence is particularly concerning for economies that overwhelmingly rely on consumption to fuel growth.

Chart of the Day: Trade Wars Negatively Impacting Manufacturing Sectors

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter