EURUSD, EUROZONE CPI, ECB – TALKING POINTS

- EURUSD may continue its decline and delve further into critical support channel

- The pair’s decline could be amplified if Eurozone CPI data undershoots forecasts

- Data may fuel rate cut bets and give ECB impetus to loosen credit, reintroduce QE

See our free guide to learn how to use economic news in your trading strategy !

EUROZONE CPI, EU-US TRADE WAR

EURUSD may fall if Eurozone year-on-year CPI data falls short of the 1.2 percent forecast, which is an-already low estimate considering price growth has not been at that level since March 2018. If it undershoots, this would fall in line with the broader trend of underperformance in economic data where for several months reports have fallen short of economists’ estimates.

Furthermore, a lower-than-expected CPI print could fuel rate cut bets and provide further impetus for the ECB to reintroduce QE. Overnight index swaps are already showing an 85 percent probability of a cut by the September meeting which will only be amplified by signs of slower price growth. Christine Lagarde will be taking over Mario Draghi’s position as ECB President and will likely follow in his policy footsteps.

Growing trade tension between the EU and US may weigh on consumer and business confidence and further weigh on inflationary pressure. Washington and Brussels are in the processing of a resolving a 14-year-old dispute with the WTO as the meditating officer. A resolution to the quarrel will be announced by the end of the summer, though it may not be an outcome markets will welcome. It could be another tit-for-tat tariff tiff.

Follow me on Twitter @ZabelinDimitri to stay up to date on market-moving geopolitical risks!

EURUSD TECHNICAL ANALYSIS

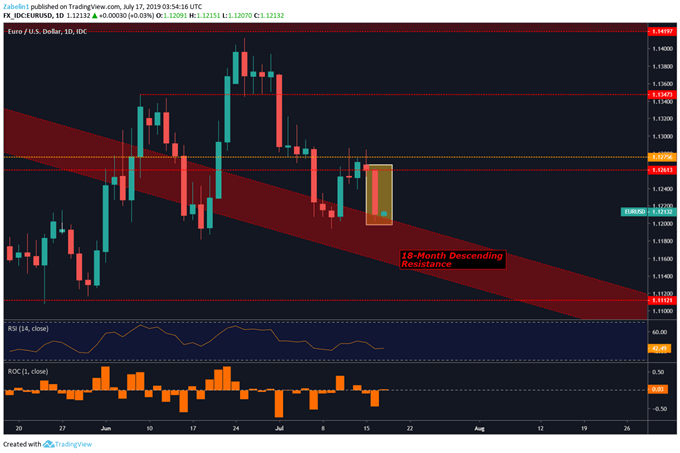

The pair is now within spitting distance of the upper bound of the 18-month descending resistance-now-turned-support channel. During Monday’s trading session the pair failed to break below, though the extended wick indicates a modest flirtation with the idea. Underperforming CPI data may be a catalyst in pressuring EURUSD lower to renter the channel and resume its previous downtrend at a steeper slope.

CHART OF THE DAY: EURUSD COQUETTISHLY APPROACHES KEY SUPPORT CHANNEL

EURUSD TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter