EURUSD FORECAST, EUROZONE GROWTH– TALKING POINTS

- EURUSD may suffer if industrial production data shows weakness

- European Commission has revised the growth outlook down again

- Traders may flock to the US Dollar if report induces risk aversion

See our free guide to learn how to use economic news in your trading strategy !

EURUSD may fall if Eurozone industrial production data misses its estimates and falls in line with the broader trend of economic underperformance in the region. Month-on-month factory orders out of Germany, the largest Eurozone economy, contracted 2.2 percent in June, more than the -0.2 percent forecast. The ECB has recently alluded to its willingness to reintroduce rate cuts and QE if the economic circumstances warrant it.

On July 10, the EU Commission – the executive arm of the European Union – lowered its forecasts for growth and inflation in light of growing downside risks and uncertainty over US trade policy toward Europe. Trade tensions between Brussels and Washington may continue to escalate as the latter presses the WTO to look into the former’s subsidies to Airbus, a multi-billion Euro aeronautic company.

Furthermore, escalating tensions between the US and EU over Iran may result in sanctions placed against Europe if it continues to undermine Washington’s attempts to pressure Iran into cooling its nuclear ambitions. Less than two weeks ago, news broke that Tehran had allowed for uranium enrichment to go past the predetermined levels outlined in the 2015 nuclear accord. How will the EU balance pleasing the US and Iran?

To learn more about how politics affects financial markets, follow me on Twitter @ZabelinDimitri.

EURUSD TECHNICAL ANALYSIS

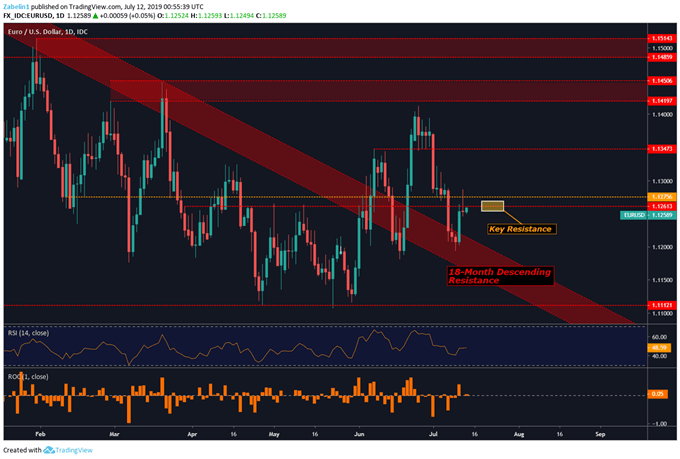

EURUSD is now hovering below familiar resistance at 1.1261 and the path of least resistance suggests capitulation and a resumption of the broader downtrend. Over the past few days the pair has retested the 18-month descending resistance channel, though the sudden bounce from it suggests traders are not yet ready to trade in that zone again. However, the longer-term outlook appears biased toward a weaker EURUSD.

CHART OF THE DAY: EURUSD MAY NOT BE ABLE TO OVERCOME KEY RESISTANCE

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter