TALKING POINTS – EURUSD FORECAST, US DURABLE GOODS ORDERS, PMI DATA

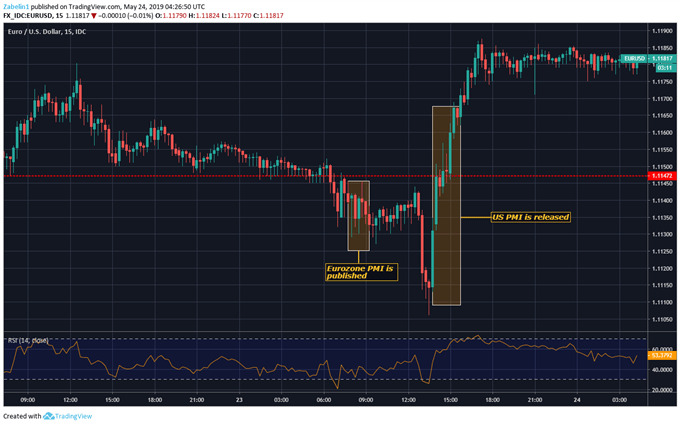

- EURUSD falls on Eurozone PMI – recovers during US session

- US durable goods orders may spark volatility in USD-crosses

- SEK, NOK shrug on better-than-expected unemployment data

See our free guide to learn how to use economic news in your trading strategy !

APAC RECAP: TRADE WARS, RISK AVERSION

Prior to the start of APAC trading hours, crude oil prices and S&P 500 futures plunged after news crossed the wires that US-China trade relations had taken a turn for the worse. Compounding the risk aversion was disappointing Eurozone PMI data that sent EURUSD lower, though the pair recovered after US PMI fell short of expectations. During most of the APAC session, equities found themselves broadly swimming in red.

Trade war concerns may now carry greater weight after officials at the Fed – more specifically, James Bullard – stated that the economic spat between Beijing and Washington may soon begin to impact monetary policy. Economic data out of the US has been tending to underperform relative to economists’ expectations, and if trade relations worsen, this trend may not only continue but would likely accelerate.

VOLATILITY AHEAD OF US DURABLE GOODS ORDERS

Prior to the release of US PMI, overnight index swaps were showing a 50 percent probability of a cut by the Fed’s meeting in October. After the data was published, that number shot up to 62 percent. The upcoming publication may therefore carry greater weight insofar that it will provide market participants on the projected demand in the US economy. If the data falls short of estimates, rate cut bets will likely only increase.

European trading hours have no major event risk scheduled, so it is likely that most of Euro price action will be driven by counter-currency risks and ongoing fundamental themes e.g. trade wars and Brexit. European parliamentary elections that are currently underway may spark some volatility if preliminary results are showing Eurosceptic parties making significant gains in this year’s election.

NORDIC UPDATE: SWEDEN, NORWAY UNEMPLOYMENT RATE

Swedish and Norwegian unemployment data came in better-than-expected, though surprisingly the impact on NOK and SEK was relatively limited. However, during the bout of risk aversion, the oil-linked Krone suffered as Brent plummeted to $67 per barrel. This in large part has to do with the structure of Norway’s economy. To learn more about the Swedish Krona and Norwegian Krone, you may follow me on Twitter @ZabelinDimitri.

CHART OF THE DAY: EURUSD FALLS ON EUROZONE PMI – RECOVERS DURING US SESSION

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter