TALKING POINTS – CHINA, INDUSTRIAL PROFITS, YEN, US DOLLAR, PCE

- Aussie, NZ Dollars rise as Yen falls in risk-on APAC session

- Chinese industrial profits surge, snapping 2-month loss streak

- Disappointing US PCE data may sour market sentiment anew

The sentiment-geared Australian and New Zealand Dollars narrowly outperformed while the anti-risk Japanese Yen edged lower as risk appetite firmed in Asia Pacific trade. The absence of Tokyo made for thin conditions but Chinese names led regional bourses to a narrow gain.

That may reflect a response to data published over the weekend showing Chinese industrial profits jumped 13.9 percent on-year in March. The outcome snapped a 2-month losing streak and marked the fastest growth rate since July 2018. This might have eased trade war worries somewhat.

The spotlight now turns to the US personal spending and incomedata set. Narrow improvements are expected but a disappointment may be in the cards if the outcomes echo the trend toward disappointment relative to forecasts on macro news-flow over recent months.

The Fed’s favored PCE inflation gauge is perhaps the most eye-catching bit of the release. Baseline projections envision the slowest price growth in over a year. That might be read as indicative of fizzling economic momentum, feeding global slowdown fears.

Prevailing sentiment trends may flip to a “risk-off” setting in this scenario (although follow-through may be limited ahead of Wednesday’s FOMC rate decision). That might see the US Dollar return to the offensive alongside the Yen while commodity-bloc currencies backtrack.

Bank of England Governor Mark Carney is also due to speak. Absent a bonafide bombshell, his remarks are unlikely to stir the British Pound as markets await the official policy announcement and quarterly Inflation Report (QIR) due Thursday before showing committing directional commitment.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

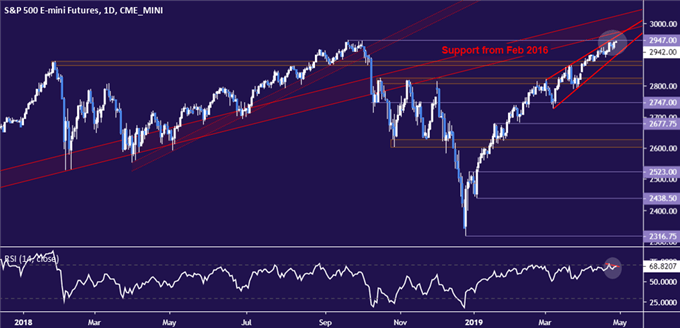

CHART OF THE DAY – EVIDENCE OF S&P 500 TOP CAUTIOUSLY MOUNTING

Signs of topping continue to accumulate on the daily S&P 500 chart. Prices continue to hover below the 2018 swing high at 2947, sitting squarely at resistance reinforced by the top of a bearish Rising Wedge chart pattern and the underside of former support set from February 2016.

Negative RSI divergence now bolsters the case for reversal lower, although confirmation is absent. To begin securing that, a first step would be to break below Wedge support – now at 2900 – on a daily closing basis. From here, downside barriers appear at 2865.00 and 2807.50.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter