TALKING POINTS – US DOLLAR, CONSUMER CONFIDENCE, YEN, TRADE WAR, NOK

- US Dollar may rise on soggy UofM consumer confidence data

- Yen lower as trade war de-escalation hopes lift APAC bourses

- Norwegian Krone gains as Prime Minister shores up coalition

The University of Michigan measure of US consumer confidence stands out on an otherwise dull economic calendar through the end of the trading week. The US government shutdown has dramatically slowed incoming news-flow, leaving investors pining for timely indicators offering a view of near-term economic conditions. That might make this release more market-moving than usual.

The headline sentiment index is seen ticking lower to 96.8. While that would be a five-month low, it would not amount to a dramatic departure from the prevailing upward trend. A disappointing outcome reflecting a raft of worries – like fiscal headwinds from the shutdown as well as disruption and uncertainty linked to the US-China trade war – may translate into broad-based risk aversion.

Perhaps counter-intuitively, the US Dollar might fare relatively well against such a backdrop. The benchmark currency has proven to be remarkably resilient despite the collapse of priced-in Fed rate hike expectations over the past two months. In fact, it rose to a 20-month high amid a vicious late-year market rout before pulling back as risk appetite steadied. That speaks to strong haven appeal waiting to entice anew.

YEN DOWN AS APAC STOCKS RISE, NOK UP AS PM SHORES UP COALITION

The Japanese Yen narrowly underperformed in otherwise quiet Asia Pacific trade. The perennially anti-risk unit tracked lower as local stock markets followed Wall Street higher. The newswires chalked optimism to rumors that US Treasury Secretary Steven Mnuchin is pushing to scale back tariffs on China, despite a forceful official denial of any such effort.

Meanwhile, the Norwegian Krone traded broadly higher after Prime Minister Erna Solberg reached a deal with the Christian Democratic Party to broaden her ruling coalition. The move secures a legislative majority aimed at pushing through a raft of market-friendly policies, including tax cuts.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

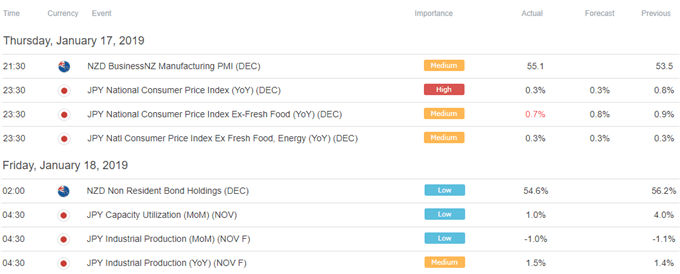

ASIA PACIFIC TRADING SESSION

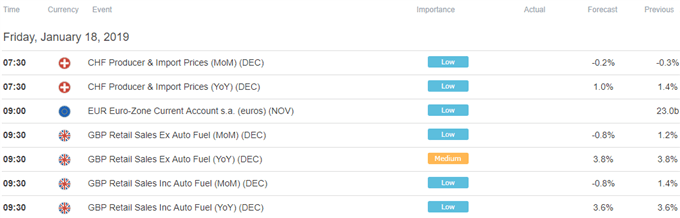

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter