TALKING POINTS – POUND, BREXIT, US DOLLAR, FOMC, TRADE WAR, CHINA

- British Pound vulnerable as the UK Parliament debates Brexit deal

- US Dollar may rise as FOMC minutes make the case for rate hikes

- Yen down, Aussie and NZ Dollars up on US-China trade deal hopes

Brexit returns to the spotlight Wednesday as the Parliament resumes debate on the terms of the UK withdrawal from the European Union. Lawmakers handed Prime Minister Theresa May another legislative defeat yesterday, with members of her own Conservative party voting with the opposition to limit her tax-varying powers in the event of the dreaded “no-deal” divorce.

That does not bode well for Ms May’s ability to sell the Brexit deal that she agreed with Brussels ahead of a vote on its adoption next week. In the meantime, the EU has roundly rejected renegotiation. Against this backdrop, BOE Governor Mark Carney will hold an online Q&A session, where he may well signal a dovish disposition as the political stalemate continues. All this might lead the British Pound lower.

US DOLLAR MAY RISE AS FOMC MINUTES MAKE CASE FOR RATE HIKES

Later in the day, the spotlight will turn to minutes from December’s FOMC meeting. It culminated in a forecast calling for two rate hikes in 2019. The priced-in outlook implied in Fed Funds futures suggests the markets expect none. If the Minutes document makes a compelling case for policymakers’ side of the argument, the US Dollar is likely to rise.

US-CHINA TRADE DEAL HOPES HURT YEN, BOOST COMMODITY CURRENCIES

The anti-risk Japanese Yen underperformed while the sentiment-geared Australian, Canadian and New Zealand Dollars traded alongside stocks in Asia Pacific trade. Hopes for a breakthrough in US-China trade talks seem to be stoking investors’ optimism after a delegation of officials from Washington DC extended its stay in Beijing for an extra day.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

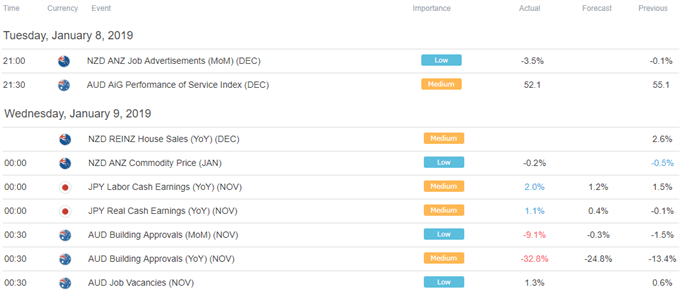

ASIA PACIFIC TRADING SESSION

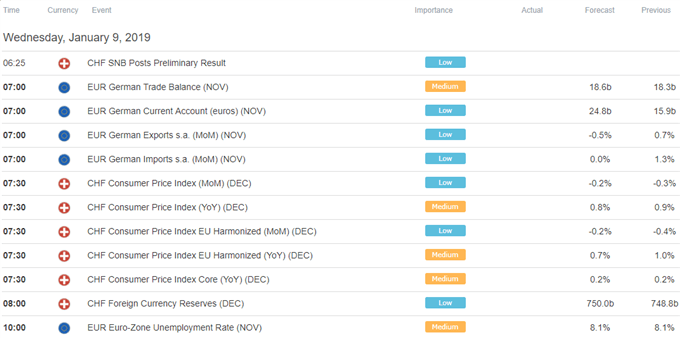

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter