TALKING POINTS – US DOLLAR, YEN, FED, BRITISH POUND, UK CPI, EURO, ITALY

- US Dollar, Yen may rise as the Fed maintains a hawkish policy bias

- British Pound unlikely to find a lasting catalyst in UK inflation data

- Euro higher on hopes EU Commission will ratify Italy budget deal

The US Dollar is trading broadly lower ahead of the opening bell in Europe amid pre-positioning for the FOMC monetary policy announcement. The markets are angling for a dovish outcome. A rate hike is expected but traders envision a dovish shift in the central bank’s forecast for 2019.

The priced-in rate hike outlook implied in Fed Funds futures has dramatically deteriorated in recent weeks. Having fully priced in two hikes next year as recently as early November, it now puts the probability of just one increase as a barely better-than-even 56 percent.

A shift in Fed rhetoric against the backdrop of falling stock prices seems to be behind the adjustment. That might amount to wishful thinking however. While global economic activity has certainly decelerated and risk aversion looks acute, a mandate-minded US central bank seems likely to tighten further.

The latest CPI data put inflation on-trend for the year at 2.2. percent, wage growth is at a nine-year of 3.1 percent, and the jobless rate continue to hover at the lowest in five decades. For their part, Fed officials have consistently said that they will not back down unless a turn in the relevant data compels them.

The markets seem convinced that – when push comes to shove – the Chair Powell and company will relent. If they are wrong on that score, the US Dollar is likely to push aggressively higher. Sentiment will probably deteriorate as well in this scenario, bidding up the perennially anti-risk Japanese Yen.

BRITISH POUND MAY MOSTLY OVERLOOK UK CPI DATA

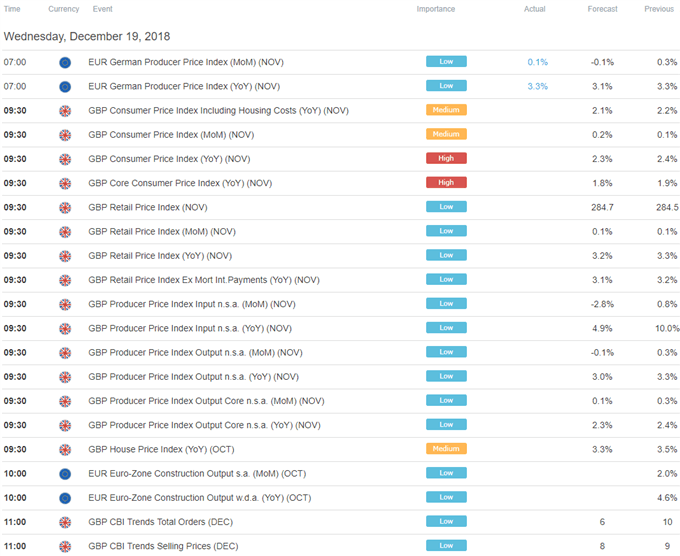

UK CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to tick down to 2.3 percent while the core measure excluding volatile items like food and energy backs down to 1.8 percent.

Outcomes echoing deterioration in UK economic news flow relative to forecasts over the past three months may prove softer still. That may not amount to lasting selling pressure on the British Pound however considering its limited implications for near-term BOE monetary policy.

The central bank seems decidedly unlikely to raise rates as the threat of a “no-deal” Brexit looms large. The markets seem to agree: the priced-in outlook does not envision an increase at least until November of next year. With that in mind, there does not appear to be much room for a dovish shift in expectations.

EURO GAINS ON HOPES EU TO RATIFY ITALY BUDGET DEAL

The Euro outperformed in Asia Pacific trade amid reports that the European Commission may ratify an informal deal with Italy ending a months-long budget standoff and avoiding punitive measures. The spread between Italian and German 10-year bond yields has tellingly dropped to a three-month low.

The newswires have circulated comments from an unidentified Italian Treasury official saying the Commission will support a deal that puts Rome’s budget deficit at 2.04 percent of GDP next year. That’s down from the 2.4 percent in an earlier budget proposal that was rejected by Brussels.

See our free guide to learn how to use economic news in your trading strategy !

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter