TALKING POINTS – YEN, FRANC, AUSSIE DOLLAR, CHINA, TRADE WAR, HUAWEI, BREXIT

- Yen soar as US/China trade détente hopes fade on Huawei CFO arrest

- Stock futures hint risk aversion aims to continue in European, US trade

- British Pound volatility elevated as PM May struggles with Brexit deal

The anti-risk Japanese Yen and Swiss Franc rose while the sentiment-geared Australian, Canadian and New Zealand Dollars plunged as risk appetite evaporated in Asia Pacific trade. The move follows news that Huawei CFO Wanzhou Meng was arrested in Canada on allegations of violating US sanctions on Iran. This seemed to amplify disappointment with the apparent absence of progress on trade war de-escalation at a meeting between US and Chinese presidents Trump and Xi at the weekend’s G20 summit.

More of the same looks likely ahead. A lackluster offering of lower-tier releases on the European and US economic calendars seems likely to keep sentiment trends at the forefront. Bellwether S&P 500 futures are down over a full percentage point before Wall Street comes online, hinting that the risk-off trading patterns on display in APAC trade have scope for follow-through.

BRITISH POUND VOLATILITY LIKELY AMID BREXIT DEAL SCRAMBLE

Meanwhile, UK Prime Minister Theresa May continues to struggle to build support for her Brexit deal proposal ahead of a decisive vote in Parliament next week. The Times said members of the Ms May’s cabinet are trying to talk her into postponing the vote while the Telegraph claimed that EU officials are considering a delay in triggering Article 50 of the Lisbon Treaty pulling the UK from the regional bloc.

On balance, this makes for an unusually elevated British Pound volatility risk. In fact, one-week implied Sterling volatility expressed in FX options jumped to the highest level since June 2017 yesterday and stands at the highest among the major currencies. Headlines making a no-deal Brexit appear more likely are likely to weigh on the UK unit while anything that lowers the chance of or delays such an outcome may boost it.

See our free guide to learn how to use economic news in your trading strategy !

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

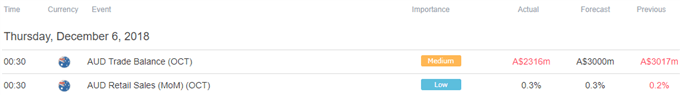

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter