TALKING POINTS – TRADE WAR, CHINA, YEN, US DOLLAR, ECB FORUM

- Yen, Swiss Franc rise as US, China trade war sours risk appetite

- FTSE 100, S&P 500 index futures hint more of the same is ahead

- ECB Forum is getting started but may be overshadowed for now

The anti-risk Japanese Yen and Swiss Franc pushed higher for a second day in Asia Pacific trade as an escalating trade war between the US and China sent markets scrambling. Regional bourses bled, with the regional MSCI equities benchmark on pace to suffer its largest loss in seven days at 1.3 percent. The sentiment-linked Australian Dollar bore the brunt of selling pressure in the G10 FX space.

BACKGROUND: A Brief History of Trade Wars, 1900-Present

Looking ahead, a quiet offering on the economic data front is likely to keep trade tensions in the spotlight. Futures tracking the FTSE 100 and S&P 500 equity benchmarks are pointing sharply lower, hinting the risk-off mood is set to persist when London and New York come online. That means overnight price dynamics are likely to find follow-through.

The ECB Forum in Sintra, Portugal is also of note. Top central banks’leaders will join eminent economists to discuss price- and wage-setting in advanced countries. That gets at the heart of the post-crisis challenge facing policymakers: growth and labor markets have recovered but inflation remains stubbornly low across much of the developed world. This has prolonged ultra-loose monetary policy settings.

These talks are made particularly poignant by the immediate impact of the forces being discussed on asset prices. Last week was defined by a sharp surge in the US Dollar and a sinking Euro after the Fed – the leader in policy normalization – sounded a hawkish tone while the ECB signaled an overwhelmingly dovish disposition even as it planned to end its QE program.

The announcements seemed to sound the death knell for the “catch-up” narrative envisioning top central banks chasing after the Fed’s hawkish lead amid broadening economic recovery. That this would shrink the greenback’s yield advantage accounted for most of its losses in 2017. Repricing for a strong-USD world shaped by a widening policy gap between the Fed its peers has already pushed it to an 11-month high.

To that end, traders will almost certainly scrutinize soundbites from Sintra for their immediate policy implications, which may inspire volatility across financial markets. To the extent that they bolster the sense that the Fed stands mostly alone in its readiness to tighten with gusto, the outing might offer the US unit fresh fodder for gains. Trade war concerns may overshadow this narrative in the very near term however.

See our free guide to learn how to use economic news in your trading strategy !

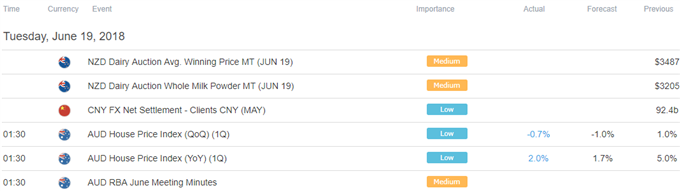

ASIA PACIFIC TRADING SESSION

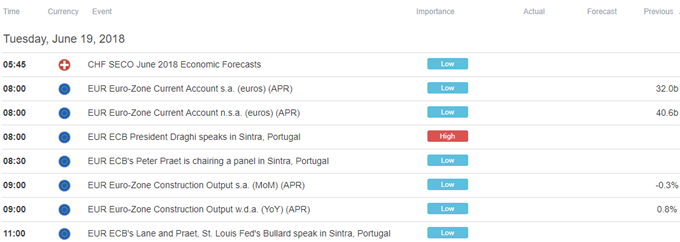

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter