TALKING POINTS – BANK OF ENGLAND, BRITISH POUND, US DOLLAR, YEN, FOMC

- Yen higher as markets digest US/China trade war de-escalation

- US Dollar may rebound as the spotlight turns to FOMC minutes

- British Pound looks to testimony from BOE officials for direction

The Yen edged up in otherwise quiet Asia Pacific trade, with the G10 FX space settling into digestion mode following yesterday’s fireworks. Commodity-bloc currencies notched up impressive gains as risk appetite firmed after China and the US opted against an all-out trade war, at least for now. Not surprisingly the chipper mood weighed on the anti-risk Japanese unit. Today’s upswing seems corrective in that context.

From here, the celebratory mood may give way to a bit of sober reflection. No formal deal between the world’s top-two economies has been stuck, making this a temporary lull in hostilities that may yet crumble. Investors are unlikely to know for sure until formal negotiations run their course, which may take months. In the meantime, the focus may turn to Wednesday’s release of minutes from May’s FOMC meeting.

The upsurge in commodity-linked and emerging market currencies translated into broader US Dollar weakness yesterday. If Fed policy speculation returns to the forefront, traders leery of being caught wrong-footed by a hawkish outcome might opt to neutralize exposure, sending the greenback upward. The realization that smoother trade relations allow Chair Powell and company greater room to tighten might help too.

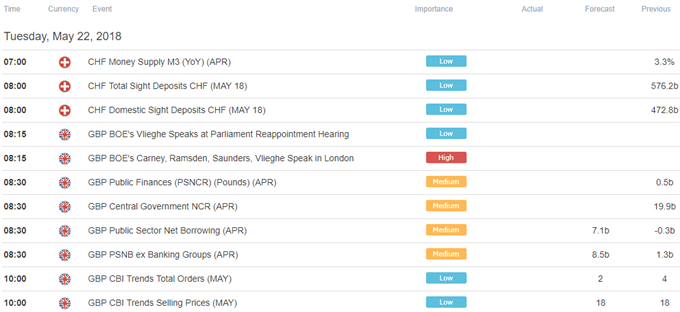

The Bank of Englandis in focus in European hours as Governor Carney leads a group of officials in testimony on the latest Quarterly Inflation Report – the document outlining the near-term policy path – before Parliament’s Treasury Committee. It marked a dovish turn in forward guidance. More of the same may put pressure on the British Pound as 2018 rate hike chances dwindle.

With that said, Sterling has already lost a lot of ground working off overly optimistic bets that assigned a near-90 percent chance of a June hike just two months ago. Now, the chance of any increase at all this year is pegged at just over 60 percent. That means the BOE could be rather reserved – merely asserting a cautious tightening bias – and still come off relatively hawkish, sending the UK unit upward.

See our free guide to learn how to use economic news in your trading strategy !

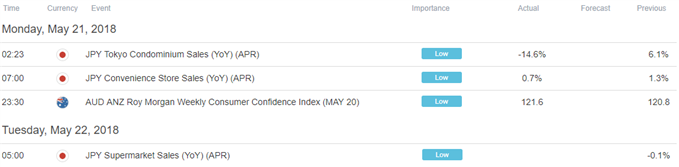

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter