TALKING POINTS – AUSSIE DOLLAR, YEN, FED, US PPI

- Yen falls as Fed boosts global rates, hurting the go-to funding currency

- Aussie Dollar down on bets US Dollar yield advantage to widen further

- A speech from the Fed’s Bostic, US PPI data unlikely to bring fireworks

The Yen underperformed in Asia Pacific trade, falling alongside gold prices while front-end US Treasury yields rose. Realized and expected Fed interest rate hikes have bid up borrowing costs globally since close to 80 percent of all monetary transactions are settled in USD. Bets on more of the same after a hawkish speech form Chair Powell are thus understandably negative for the low-yielding Japanese unit as the emerging environment encourages build-up of JPY-funded carry trades.

The Australian Dollar also declined. This too coincided with the upshift in US yields and seems to reflect the likelihood that the greenback will open a widening lead against its Aussie namesake on the top end of the G10 FX rates spectrum as the Fed continues to tighten while the RBA stands pat. Priced-in expectations don’t see Governor Lowe and company following the Fed’s lead until February 2019 at the earliest.

Looking ahead, a lull on the European economic data docket shifts the spotlight to a somewhat lackluster offering of US event risk. April’s PPI figures are expected to show a slowdown in wholesale inflation and Atlanta Fed President Rafael Bostic is due to speak. The former may pass without fireworks as the higher-impact CPI report looms ahead. Meanwhile, Mr Bostic’s cautious posture has been well-telegraphed already. On balance, a day of consolidation may be in the cards.

See our quarterly FX market forecast s to learn what will drive prices through mid-year!

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

No data.

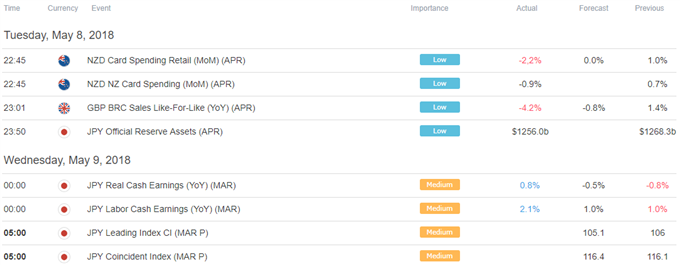

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE