Talking Points:

- British Pound may fall as soft UK GDP data cools BOE rate hike bets

- US Dollar might rise if US GDP miss cools market-wide risk appetite

- Currency markets seemingly in corrective mode in Asia Pacific trade

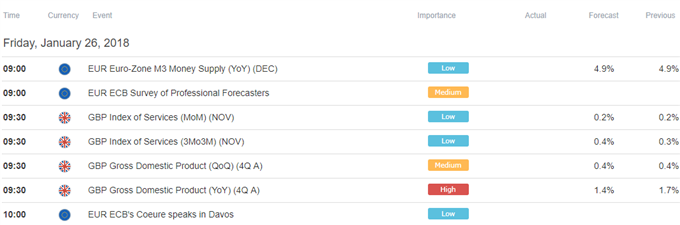

Fourth-quarter UK GDP data headlines the economic calendar in European trading hours. Expectations see output rising 0.4 percent, matching the gain in the three months through September. The on-year trend growth rate is seen dipping to 1.4 percent however, the lowest in over five years.

As it stands, financial markets are pricing in one BOE interest rate hike in 2018. A drop in the pace of economic growth may undermine that narrative, weighing on the British Pound. A sizable move with follow-through will probably require a meaningful downside surprise beyond the projected slowdown however.

Later in the day, the analogous fourth-quarter US GDP report will cross the wires. The annualized pace of growth is seen slowing to 3 percent, down from 3.2 percent in the prior period. Still, this would suggest the US economy enjoyed its best performance since 2006 last year.

Realized data outcomes out of the world’s largest economy have increasingly deteriorated relative to consensus forecasts in the past month, opening the door for another downside surprise. With Fed rate hike bets relatively stable, such a result might punish market-wide risk appetite rather than the US Dollar.

In fact, the greenback has been severely battered even as the 2018 tightening path priced into Fed Funds futures steepened since November. That seems to reflect bets that a rosy global growth path will inspire global catch-up to the US central bank’s hawkish lead. A soft US GDP print might cool such speculation.

Currency markets seemed to be in corrective mode in Asia Pacific trade. The greenback retreated having enjoyed a late-day lift on supportive comments from President Donald Trump. Meanwhile, the Australian Dollar rebounded, retracing some of yesterday’s losses.

Find out here how recent price action has matched up with our first-quarter US Dollar forecast !

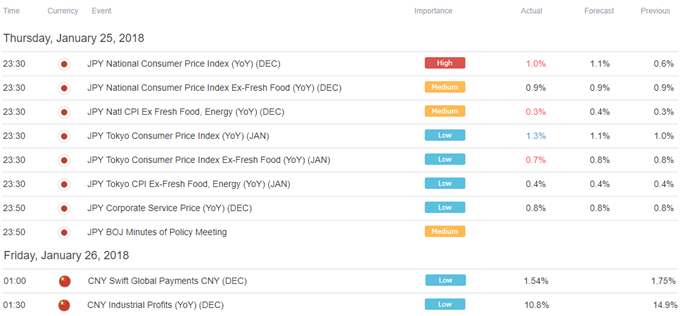

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak