Talking Points:

- US Dollar may fall as soft CPI, retail sales data cool Fed rate hike bets

- Aussie and NZ Dollars correct lower following sentiment-driven advance

- Euro extends rise after ECB meeting minutes hint at sooner QE unwind

A lull in noteworthy European economic data will see investors looking ahead as December’s USCPI and retail sales figures cross the wires. The headline on-year inflation rate is expected to tick gently lower, from 2.2 to 2.1 percent. Receipts are expected to add 0.5 percent from the prior month, marking a slight slowdown from the prior month but registering near the trend average.

US economic news-flow has notably deteriorated relative to consensus forecasts in recent weeks, hinting that analysts’ models may be overly optimistic and opening the door for further downside surprises. Such results might undermine the case for an interest rate hike in March, an outcome that is currently assigned an 82 percent probability by the markets. Needless to say, such a scenario will probably bode ill for the US Dollar.

The Australian and New Zealand Dollars corrected lower in Asia Pacific trade. The two sentiment-linked currencies outperformed against their G10 FX counterparts amid a broad-based swell in risk appetite yesterday. Meanwhile, the Euro continued to build higher, buoyed by minutes from December’s ECB meeting where policymakers seemed to hint that they may pull back on QE faster than previously expected.

What are the top trading opportunities that DailyFX analysts see in 2018? Find out here !

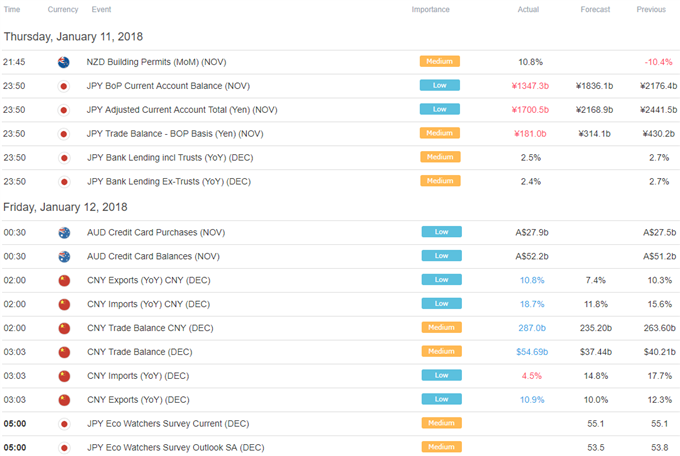

Asia Session

European Session

No Data.

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak