Talking Points:

- Aussie Dollar may fall further as RBA’s Lowe talks down rate hike prospects

- British Pound may decline as BOE policymakers defend dovish disposition

- US Dollar looks to Yellen speech for clues about 2018 tightening trajectory

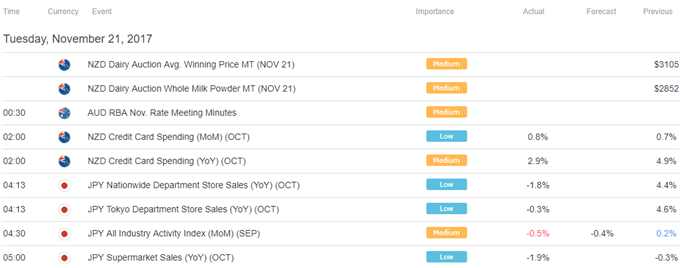

The Australian and New Zealand Dollars underperformed in otherwise quiet Asia Pacific trade. Both currencies managed a recovery yesterday – a move that appeared corrective following last week’s sentiment-driven losses – but sellers appear to have taken that as an opportunity. The Aussie suffered outsized losses after minutes from this month’s RBA policy meeting struck a familiarly dovish tone.

The currency may be in for further losses as RBA Governor Philip Lowe takes to the wires (at 9:05 GMT). He will probably stick to a well-worn message, bemoaning the negative impact of Aussie strength and reiterating that tightening elsewhere will not compel the Australian central bank to follow suit. The markets have been surprisingly responsive to such jawboning despite its familiarity however.

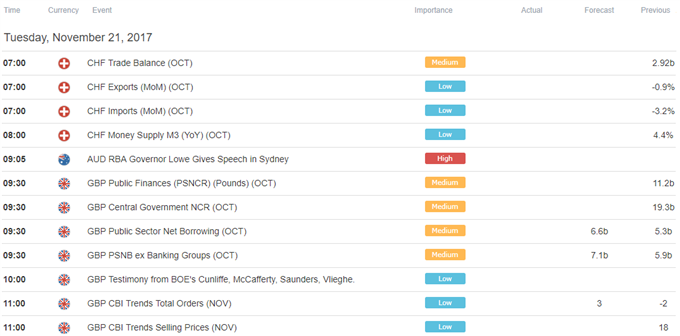

From there, the spotlight will turn to London as a group of BOE officials including Jon Cunliffe, Ian McCafferty, Michael Sauders and Gertjan Vlieghe testify before Parliament’s Treasury committee on the latest Inflation Report. That might prove negative for the British Pound as policymakers justify a broadly dovish posture despite increasingly above-target inflation.

A speech from Fed Chair Janet Yellen is next in focus. She has announced her departure from the US central bank after Governor Jerome Powell passes Congressional confirmation and formally takes the reins in February. That might make for a somewhat more candid outing. The most potent bits for the US Dollar will probably concern the extent to which fiscal policy will shape the pace for tightening in 2018.

What do retail traders’ buy/sell decisions hint about on-coming FX market moves? Find out here !

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak