Talking Points:

- Australian, NZ Dollars match divergence in local bond yields

- Pound may fall if BOE officials echo dovish Governor Carney

- US Dollar may rise as Fed’s Brainard backs FOMC consensus

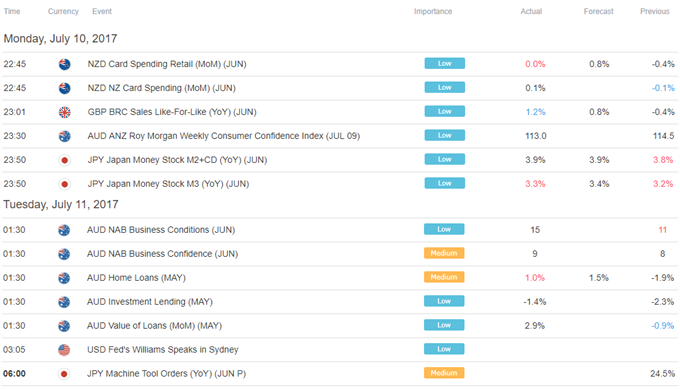

The New Zealand Dollar underperformed in overnight trade, falling against all of its G10 FX counterparts. The move lower tracked a drop in local front-end bond yields, hinting that a dovish shift in RBNZ policy expectations was the culprit behind the selloff. Soft card spending numbers seem too flimsy of a catalyst for the move however, making a mystery of the reason for investors’ change of heart.

By contrast, the Australian Dollar and its corresponding bond yields moved higher in tandem. Here too, the day’s offering of domestic economic data didn’t seem to make a strong impression, clouding the reasons for traders’ apparently more supportive view of RBA policy prospects. The Japanese Yen continued to fall as most Asian stock exchanges firmed, sapping demand for the standby anti-risk currency.

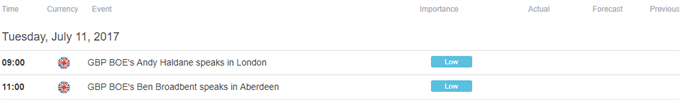

From here, a thin offering on the economic data front puts comments from central bank officials in focus. First, the spotlight turns to scheduled speeches from BOE Chief Economist Andy Haldane and Deputy Governor Ben Broadbent. Dovish rhetoric echoing recent remarks from Governor Mark Carney may clash with a month-long surge in priced-in rate hike bets, pushing the British Pound downward.

Next up, Fed Governor Lael Brainard – the most vocally dovish member of the rate-setting FOMC committee – will offer her thoughts. If even she supports the case for another rate hike this year, skeptical financial markets may be moved to shift baseline expectations closer to that of policy officials, boosting the US Dollar. Significant follow-through is unlikely until Fed Chair Yellen speaks however.

Read the latest forecasts to see what will drive the major currencies in the next 3 months!

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak