Talking Points:

- Yen higher on anti-risk flows as Asian stock markets swoon

- US Dollar may rise if ADP, services ISM data outperform

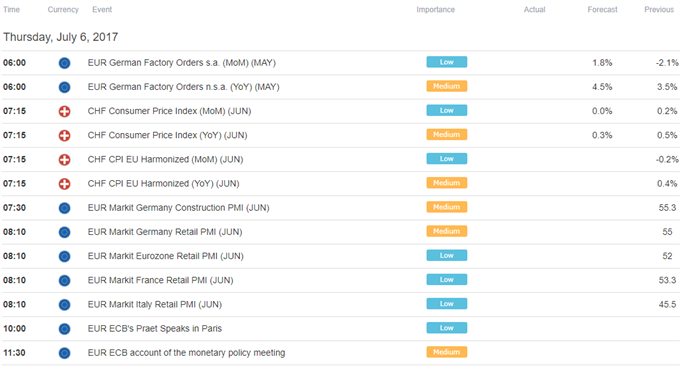

- Minutes from June ECB meeting may stoke Euro volatility

The Japanese Yen outperformed in otherwise quiet Asian trade. Regional stocks declined, offering support to the standby anti-risk currency. Newswires attributed the sour mood to worries about further Fed tightening after minutes form the FOMC’s June meeting struck a hawkish tone. Futures markets now imply a better-than-even chance of another rate hike before year-end, an outcome seen as unlikely just a week ago.

From here, a lackluster European data docket may see the markets looking ahead to US releases. A private-sector estimate of US jobs growth from ADP and the ISMnon-manufacturing survey are due. Both are expected to show deterioration in June compared with the prior month. Upbeat results echoing recently improving US news-flow may amplify rate hike speculation and boost the US Dollar.

Minutes from June’s ECB meeting may also make a splash. The publication rarely gets stirs the markets but recent confusion about messaging may make this time different. ECB President Draghi seemingly hinted at further tapering of QE asset purchases around the corner only to have his colleagues try to walk back the remarks. Signs of a lean one way or another may fuel Euro volatility.

Where will the US Dollar and Yen go in the third quarter? See our forecasts here !

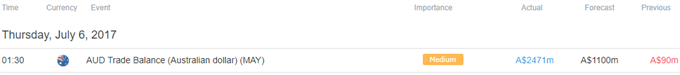

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak