Yen, USD/JPY, EUR/JPY, GBP/JPY Talking Points

- Yen strength has begun to show with prominence as US rates have continued to fall.

- USD/JPY, EUR/JPY and GBP/JPY all present possible reversal backdrops, looked at below.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

This morning provided a spark of excitement across markets as a quick risk-off move took many by surprise. Equities around the world pulled back and this held through the US open. But, as we’ve seen with so many dips before, buyers have shown up and prices have perked back up.

Outside of equities, however, signs continue to stack up that something may be afoot. Treasury yields have continued to dive with the 10 year yield moving down to another fresh four-month-low this morning. It’s odd for stock and bond prices to move in the same direction and often, that impasse doesn’t last for long. So, with stock prices holding steady near all time highs with bond prices continuing to rise, the big question is ‘which is right?’

In the currency space, the rates theme appears a little more clearly, at least around the Yen. With US rates moving higher and taking on a tone of positivity, the negative rate regime in Japan becomes that much more interesting for funding carry trades. But, as rates are compressed, the opposite can happen, and that’s what we’re seeing right now in the Japanese Yen as the currency continues to strengthen as US yields dive lower.

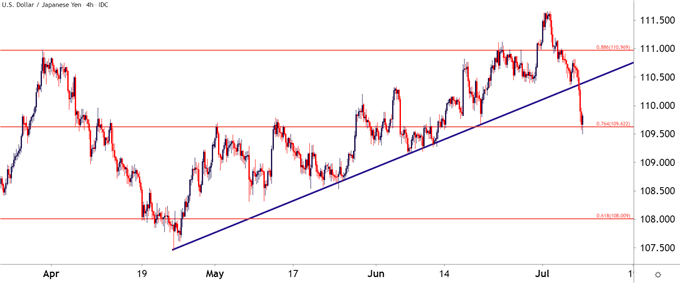

In USD/JPY, that move has been quite noticeable already this week with the pair dropping by as much as 200 pips from last week’s highs. Perhaps more interesting is the context with which this has happened, with USD/JPY testing through key support levels around 110.00 after taking out a bullish trendline that’s held the lows since late-April.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

USD/JPY Bigger Picture

Taking a step back on the chart, and this morning’s sell-off found support at a key spot. The area from 109.57-109.62 contain two different Fibonacci levels, creating a zone of confluence. This has so far quelled the pullback but, at this point, with a fresh lower-low to work with, a larger trend change may be afoot, particularly if there’s a continuation in the rates theme.

This can keep the door open for lower-high resistance tests around the 110.00 handle for bearish continuation scenarios following this trendline breach.

To learn more about Fibonacci, check out DailyFX Education

USD/JPY Daily Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

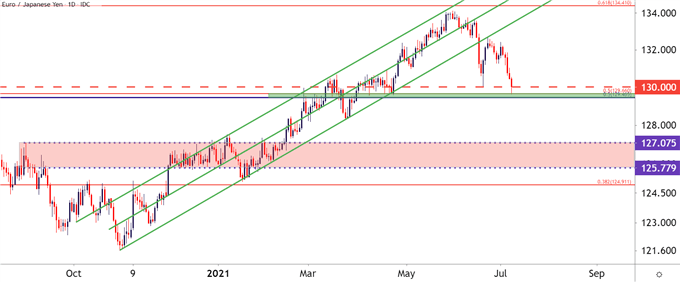

EUR/JPY

Yen strength has similarly been on display in EUR/JPY of recent, even through this morning’s ECB rate decision that saw the bank change up some policy parameters. Other factors were weighting heavy this morning, however, and the net movement in EUR/JPY has been lower as prices plunged through the 130.00 psychological level and, eventually, found support at a confluent zone of Fibonacci levels around 129.50.

Prices have bounced from that support test for now, and prices are trying to work back above the 130 psych level but, similar to USD/JPY above, there are tones of a greater reversal afoot in the pair.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley; EURJPY on Tradingview

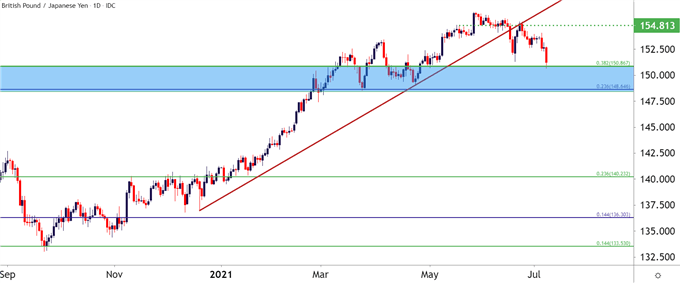

GBP/JPY

Similar story here in GBP/JPY, as Yen strength has taken-over the trend. And like both USD/JPY and EUR/JPY above, the pair has pushed down to a fresh low as the yields theme has continued.

The difference here, however subtle, is one of context, as the prevailing backdrop ahead of this morning’s bearish push wasn’t quite as threatening in GBP/JPY. And when prices dropped this morning, a familiar area of Fibonacci support came into play that’s thus far helped to hold the lows.

As looked at above, this recent sequence of lower-lows and highs keeps the door open for larger reversal themes.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley; GBPJPY on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX