WTI Crude Oil Talking Points:

- Oil started this week with a bang after a number a disruption of production in Saudi Arabia following this weekend’s drone attacks.

- Much of that breakout was quickly clawed back as Saudi Arabia said that production would largely be restored by the end of the month. But the potential for continued conflict can keep pressure on the bid, entirely dependent on how aggressively the scenario develops.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Oil Rips then Dips on Saudi Attacks

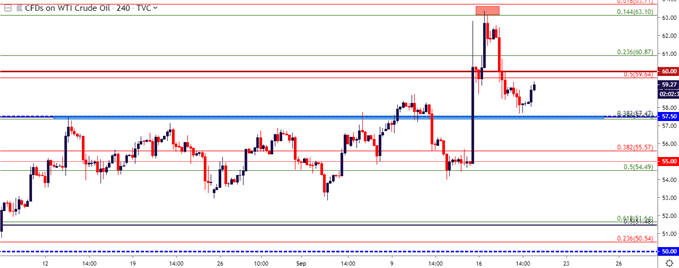

WTI crude oil prices closed last week below the 55-level, continuing to show tendencies of the range formation that had built over the prior month. The open this week saw WTI quickly push above $62 and eventually $63 as another flare in Middle East tensions threatened massive production disruptions. A drone attack that may have impacted as much as 58% of Saudi production took place over the weekend, with the wide suspicion that the drone came from Iran. So not only was current production disrupted but there was the prospect for more as this provocation could set the stage for even more tensions between the two countries and, perhaps even, an entrance into the situation by the United States.

A day later, Saudi Arabia said that production would normalize by the end of the month, with more than 50% of that lost production already being restored as of Tuesday. And given the upcoming Aramco IPO, it makes sense as to why the nation would look to keep production running high in order to keep revenues running before selling equity. This helped to bring about a 61.8% retracement of that breakout move, with support showing above a key area on the chart around the 57.50 psychological level.

WTI Crude Oil Four-Hour Price Chart

Chart prepared by James Stanley; Crude Oil on Tradingview

Oil Strategy Moving Forward

At this point the headlines are a key driver, and that can be problematic given the sheer unpredictability of that element. Surely, traders, like most people, have their own biases to how these situations will play out but, to the speculator, relying upon those opinions isn’t often a workable luxury. What the vulnerability to headlines and future developments on this theme mean is that trends can be even shorter-lived and directional prognostications are likely to be even more challenging than normal, which can mean a lower win/loss ratio for traders looking to take a stance. This can be offset, however, by looking for larger risk-reward ratios on swing trading strategies, looking to sell resistance and fade rips while looking to buy sell-offs at support with relatively tight stops so that if the level doesn’t hold, loss mitigation can be prioritized. So that lower win/loss ratio can potentially be offset by larger wins and smaller losses.

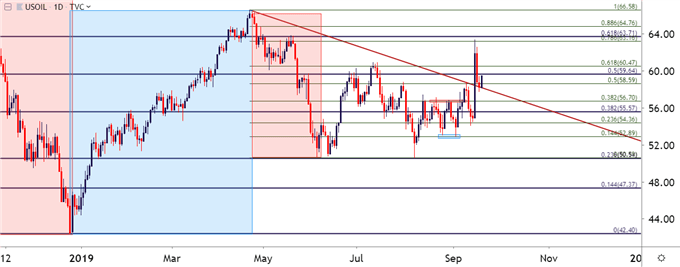

For those that are attempting to get a directional bent on the matter, topside would likely be the more attractive area, looking for a continuation of the early-week breakout after a rather aggressive pullback. Yesterday’s continuation of that pullback found support on a trendline projection as taken from the April and early-September swing-highs. The big question around that theme at this point is whether buyers can continue pushing beyond the 60 psychological level, and this would likely need a continued ramping-up of tensions in the Middle East to support that scenario.

WTI Crude Oil Daily Price Chart

Chart prepared by James Stanley; Crude Oil on Tradingview

WTI Swing Trading Levels of Interest

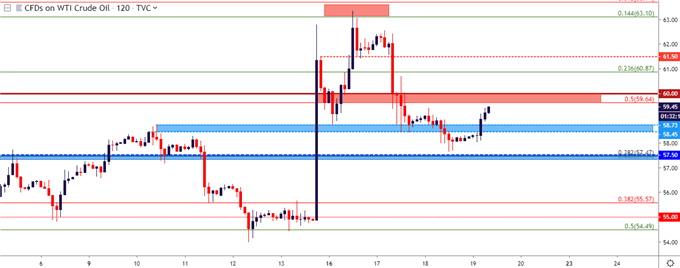

On the swing side of the matter, that area that runs from 59.64-60.00 could be compelling resistance. A resistance test there opens the door for short side swings and if that doesn’t hold, similar approaches could focus in on the 60.87 or 61.40 areas on the chart.

For bullish swing setups, traders would likely want to look for that confluent zone around the 57.50 level to come into play. A bit more aggressively, the area around 58.45-58.75 could be integrated, as well, given its show as prior resistance and short-term support in the midst of that Tuesday pullback.

WTI Crude Oil Two-Hour Price Chart

Chart prepared by James Stanley; Crude Oil on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX