Oil Price Analysis and News

- A Crude Awakening as Oil Spikes with Geopolitical Tensions Reaching Boiling Point

- Impact on Saudi Oil Output

- Geopolitical Risks on High Alert for Another Attack

A Crude Awakening as Oil Spikes with Geopolitical Tensions Reaching Boiling Point

Crude oil futures saw a record spike higher at the Asia open, with Brent crude gapping higher by 18% to hit 4-month highs following drone attacks on Saudi’s Abqaiq oil facility, which Houthi rebels had claimed responsibility for. Given its strategic necessity to the oil market, the Abqaiq oil facility is among the world’s most important facilities. In regard to the reaction across other assets, while this may seemingly help central banks in their task of hitting inflation goals, this has been viewed as economic hit with indices edging lower overnight and in the European session, while safe-havens are better bid.

Impact on Saudi Oil Output

The Saudi Energy Minister stated that the attack has caused the suspension of roughly 5-5.7mln barrels of Saudi crude production. For context, the latest OPEC monthly report showed that Saudi Arabia had an output of 9.805mbpd in August, meaning that 58% of Saudi’s crude production looks to have been disrupted, this would also be equivalent to 5% of global oil supply.

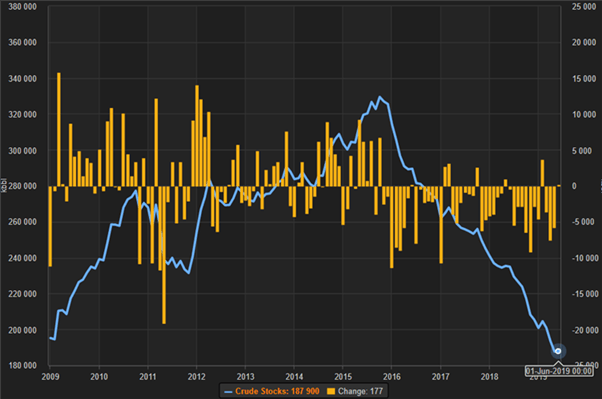

Saudi Crude Inventories

Since 2016, Saudi Arabia has been steadily drawing down its crude oil stockpiles and now has a stockpile of 188mln readily available, meaning that they have roughly 37 days of cover for the Abqaiq’s oil facility. However, with US President Trump and other nations signalling that they are ready to drawdown their oil inventories, this has helped oil prices for the time being, pulling back from its best levels. Alongside this, focus will also be Saudi’s ability to repair the damage as this will be key to gauge the impact of the supply shock.

Source: JODI

Strait of Hormuz vs Abqaiq

While twice as much oil flows through the Strait of Hormuz, militaries in the West have means in which they can open the waterway. However, with regard to Abqaiq, the facility is hard to quickly repair, circumvent and replace raising the systemic risks to the oil market.

Geopolitical Risks on High Alert for Another Attack

Understandably, geopolitical risks remain elevated as concerns mount that such an attack is not a one-off. Yemen’s Houthi rebels stated that Saudi Aramco’s oil processing plants were still a target and could be attacked at any moment. That said, eyes will also focus on Saudi’s response to the attack.

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

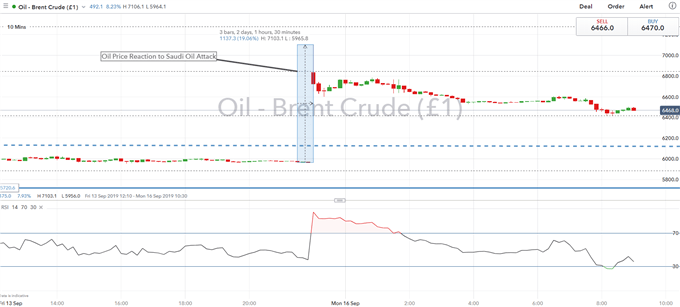

Brent Crude Price: 10-Minute Time Frame (Intra-day)

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Recommended Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX