FOMC Minutes Talking Points

- The May FOMC minutes detailed a reserved conversation among policymakers who believed that patience on rates would be appropriate for the foreseeable future.

- Many FOMC members saw the early-2019 dip in inflation readings as “transitory.”

- Rates markets show a small dip in 2019 rate cut odds relative to where they stood prior to the May FOMC minutes release.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The May Fed meeting minutes suggest that policymakers will be keeping interest rates at their current level for the foreseeable future. The May FOMC minutes echoed Fed Chair Jerome Powell’s remark at the May Fed meeting press conference that the slowdown in inflation was “transitory” and not “persistent.” It’s worth noting that US inflation expectations have subsided in the weeks since the May Fed meeting.

In accordance with the FOMC’s neutral view, the minutes noted that “members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time.” Earlier this year, the March Summary of Economic Projections’ dot plot suggested that FOMC members did not believe rates would move for the rest of 2019, before one 25-bps rate hike in 2020.

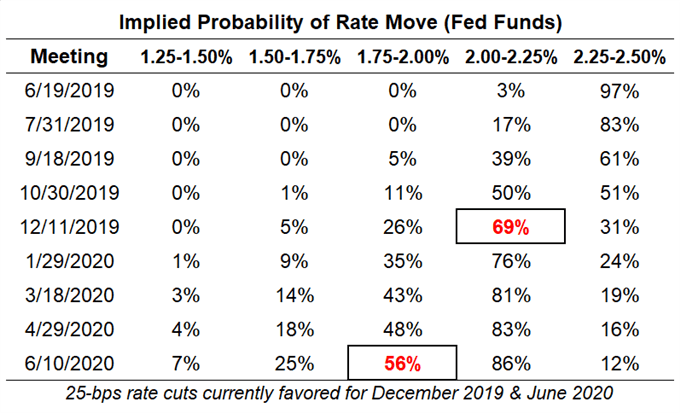

Fed Funds Futures Rate Expectations (May 22, 2019) (Table 1)

Following the May FOMC minutes, Fed funds futures were pricing in 69% chance of a 25-bps rate cut by the end of 2019 – barely lower than the 70% odds seen prior to the release.

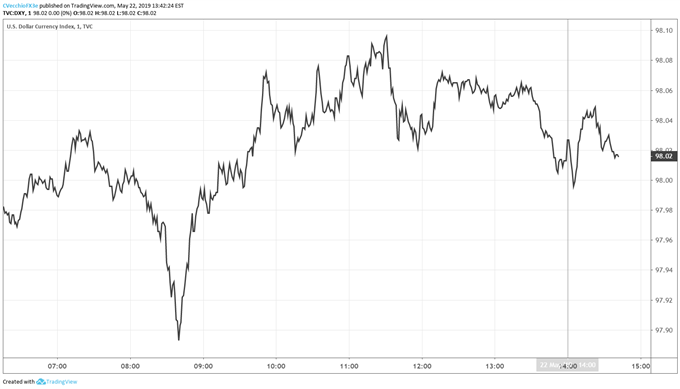

DXY Index Technical Analysis: 1-minute Price Chart (May 22, 2019 Intraday) (Chart 1)

Following the release of the May FOMC minutes, the US Dollar (via the DXY Index) gyrated higher and lower, but ultimately steadied around levels seen prior to 14 EDT/18 GMT. Ahead of the release, the DXY Index was trading at 98.02, which is where it was last seen at the time this note was written.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides