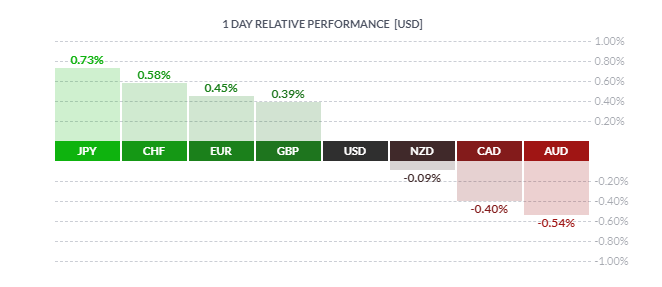

MARKET DEVELOPMENT – Oil Prices Drop as OPEC Disappoints, CAD Losses Extend

CAD: Following yesterday’s dovish BoC hold, the Canadian Dollar has weakened further with the latest dip caused by the renewed sell-off in oil prices ahead of the OPEC meeting. Today saw BoC Governor Poloz raise concerns that the economy may slow further than expected, adding that oil prices are significantly below the BoC’s forecasts in October. USDCAD hovers above 1.34, a break of 1.3450 keeps the uptrend intact.

AUD: The Australian Dollar is on the backfoot once again as trade war optimism fades rapidly after the Canada arrests Huawei’s CFO at the request of US authorities. Consequently, this has put positive progress on trade discussions between the US and China in doubt, in turn weighing on the AUD. Alongside this, while RBA Debelle highlighted that the next move in interest rates is most likely up, the rate setter did note that there could be scope for a cut, further prompting a pronounced sell-off in the AUD.

Oil: WTI and Brent crude futures sold off heavily in the European morning as the Saudi Arabia signalled that not only were they prepared for no agreement to cut production but also that cuts may be around the 1mbpd mark, which is slightly below consensus (1.2-1.3mbpd). Elsewhere, the spill-over from trade war concerns added to the bearish sentiment in oil prices. Official OPEC announcement scheduled from 1500GMT.

Data as of 1425GMT

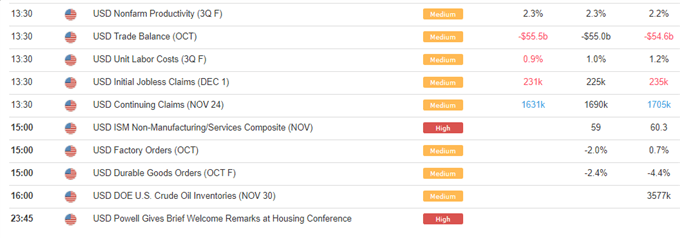

DailyFX Economic Calendar: Thursday, December 6, 2018 – North American Releases

DailyFX Webinar Calendar: Thursday, December 6, 2018

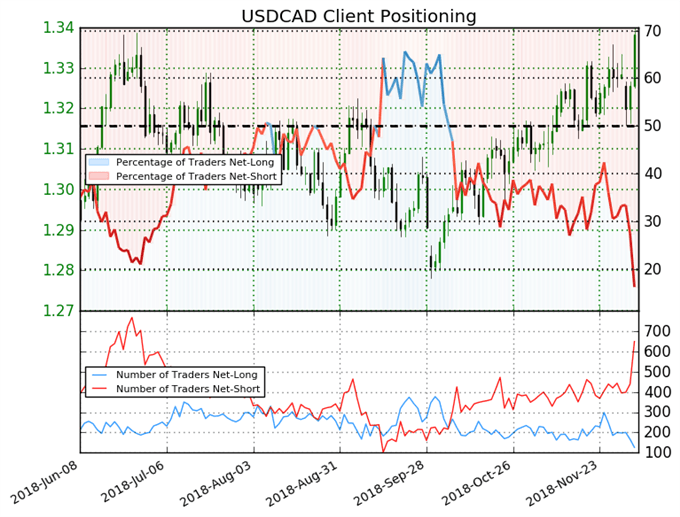

IG CLIENT SENTIMENT USDCAD Chart of the Day

USDCAD: Data shows 16.3% of traders are net-long with the ratio of traders short to long at 5.15 to 1. In fact, traders have remained net-short since Oct 09 when USDCAD traded near 1.28092; price has moved 4.5% higher since then. The number of traders net-long is 45.7% lower than yesterday and 49.8% lower from last week, while the number of traders net-short is 48.2% higher than yesterday and 23.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias

Five Things Traders are Reading

- “FTSE 100 & DAX Break Crucial Support as Trade Wars and OPEC Inspire Losses” by Justin McQueen, Market Analyst

- “US Dollar Price Action Needs NFP Confirmation, Huawei Hammers Risk”by Nick Cawley, Market Analyst

- “OPEC Latest: Oil Prices Renew Sell-Off Ahead of OPEC Meeting” by Justin McQueen, Market Analyst

- “GBPUSD: Sterling Support Remains Fragile as Brexit Chaos Continues” by Nick Cawley, Market Analyst

- “A Brief History of Major Financial Bubbles, Crises, and Flash-crashes” by Paul Robinson, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX