MARKET DEVELOPMENT – GBP VOLATILITY CONTINUES, EUR RESILIENT DESPITE GERMAN GDP CONTRACTION

GBP: Volatility is here to stay for the Pound with O/n vols via options suggesting break-evens of 148pips, while 1-week vols are implying a break-even of 228pips. Headline risk will continue to remain elevated as the Brexit cabinet meeting takes place. In the last 10 minutes, reports have suggested that Two MPs from the cabinet will resign today, briefly weighing on the Pound.

Elsewhere, subdued UK CPI figures failed to provide much in the way of price action with the majority of the attention for GBP traders on Brexit.

EUR: The Euro remains somewhat resilient in the face of the evident slowdown seen in Germany, with the country report a contraction in GDP for the first time since 2015. Elsewhere, Italian politics continues to keep the outlook for the Euro somewhat cautious with EU set to respond to the resubmitted budget proposal on November 21st. Given the lack of changes made the budget with the deficit target remaining at 2.4%, it is likely that the EU will continue to express its negative view on the budget.

Crude Oil: Yesterday saw oil prices extend its record losing streak, having dropped for a 12th consecutive session following the biggest price decline (Over 7%) since 2014. This morning, the oil complex has seen a much-needed reprieve amid some timely verbal intervention from OPEC, in which sources noted that the cartel may consider a 1.4mbpd production cut.

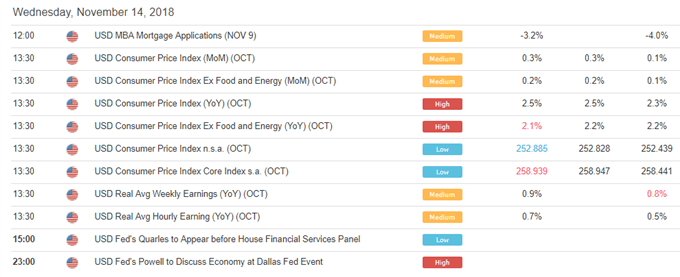

DailyFX Economic Calendar: Wednesday, November 14, 2018 – North American Releases

DailyFX Webinar Calendar: Wednesday, November 14, 2018

Five Things Traders are Reading

- “US Dollar Losses Hit Pause after October CPI; Focus Remains on Brexit” by Christopher Vecchio, CFA , Sr. Currency Strategist

- “Crude Oil Analysis: Oil Bounces on OPEC Verbal Intervention, However, Oil Glut is Coming”byJustin McQueen, Market Analyst

- “S&P 500 & FTSE 100 Outlook: Crucial Support Curbs Further Losses For Now”by Justin McQueen, Market Analyst

- “EURUSD Analysis: Negative German Growth, Italy Sticks to its Budget Plan” by Nick Cawley, Market Analyst

- “Bitcoin Cash Hard Fork Causing Market Ripples | Webinar” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX