Trading the News: Australia Consumer Price Index (CPI)

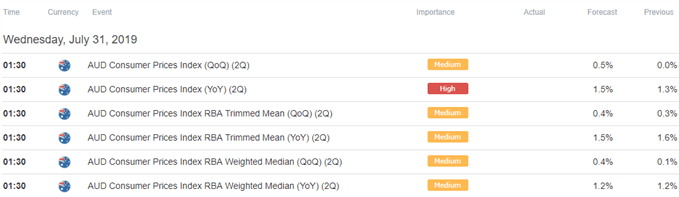

Updates to Australia’s Consumer Price Index (CPI) may impact the near-term outlook for AUDUSD as the headline reading is projected to increase to 1.5% from 1.3% per annum in the first quarter of 2019.

Signs of stick price growth may curb the recent decline in AUDUSD as it encourages the Reserve Bank of Australia (RBA) to revert back to a wait-and-see approach at the next meeting on August 6.

However, the details of the report may do little to curb the recent decline in AUDUSD as the core rate of inflation is expected to narrow to 1.5% from 1.6% during the same period. In turn, a batch of lackluster data prints may drag on the Australian dollar as it puts pressure on the RBA to further embark on its rate easing cycle.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

Impact that the Australia CPI report had on AUD/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

1Q 2019 | 04/24/2019 01:30:00 GMT | 15.% | 1.3% | -50 | -75 |

1Q 2019Australia Consumer Price Index (CPI)

AUD/USD 15-Minute Chart

Australia’s Consumer Price Index (CPI) narrowed more than expected during the first three months of 2019, with the headline reading slipping to 1.3% from 1.8% per annum in the fourth quarter of 2018. A deeper look at the report showed a similar development for the core rate of inflation, with the trimmed mean index printing at 1.6% versus projections for a 1.7% print.

The Australian dollar struggled to hold its ground following the batch of lackluster data prints, with AUDUSD falling below the 0.7050 area to close the day at 0.7015. Learn more with the DailyFX Advanced Guide for Trading the News.

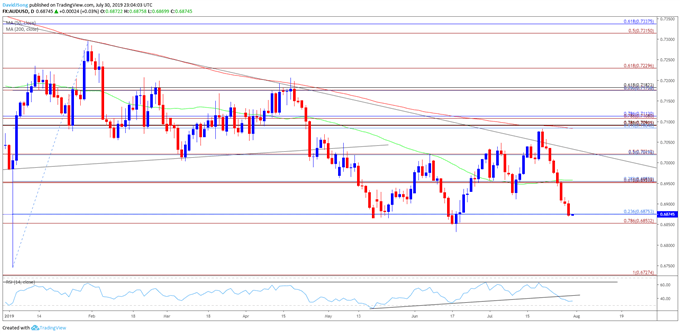

AUD/USD Rate Daily Chart

- Keep in mind,the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7083), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- In turn, the broader outlook for AUDUSD remains tilted to the downside, with the exchange rate still at risk of giving back the rebound from the 2019-low (0.6745) as both price and the Relative Strength Index (RSI) continue to track the bearish formations from late last year.

- Moreover, the advance from the June-low (0.6832) has sputtered ahead of the Fibonacci overlap around 0.7080 (61.8% retracement) to 0.7110 (78.6% retracement), which lines up with the 200-Day SMA (0.7083), with the near-term outlook for AUDUSD mired by the recent series of lower highs and lows.

- The Fibonacci overlap around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) sits on the radar, with a break of the June-low (0.6832) raising the risk for a move towards 0.6730 (100% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.