Trading the News: US Non-Farm Payrolls (NFP)

Updates to the US Non-Farm Payrolls (NFP) report may keep EURUSD under pressure as the economy is anticipated to add 160K jobs in June.

At the same time, Average Hourly Earnings are expected to pickup during the same period, and signs of a robust labor market may spark a bullish reaction in the US Dollar as the economy shows little to no signs of a looming recession.

It remains to be seen if the fresh data prints will impact the monetary policy outlook as Cleveland Fed President Loretta Mester, who does not vote on the Federal Open Market Committee (FOMC) this year, insists that “cutting rates at this juncture could reinforce negative sentiment about a deterioration in the outlook even if this is not the baseline view.”

With that said, another below-forecast NFP print may produce headwinds for the Dollar as St. Louis Fed President James Bullard, who does vote on the FOMC in 2019, suggest the central bank will insulate the US economy with an “insurance cut.”

Keep in mind, market conditions following the major US holiday may produce a limited reaction as participation remains thin going into the weekend.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the US NFP report had on EUR/USD during the previous print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAY 2019 | 06/07/2019 12:30:00 GMT | 175K | 75K | +44 | +63 |

May 2019 U.S. Non-Farm Payrolls (NFP)

US Non-Farm Payrolls (NFP) increased 75K in May after expanding a revised 224K the month prior, while the Unemployment Rate held steady at 3.6% for the second consecutive month. A deeper look at the report showed the Labor Force Participation also holding steady at 62.8%, while Average Hourly Earnings unexpectedly narrowed to 3.1% from 3.2% per annum in April.

The US Dollar struggled to hold its ground following the slowdown in job and wage growth, with EURUSD climbing above the 1.1300 handle to close the day at 1.1332. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

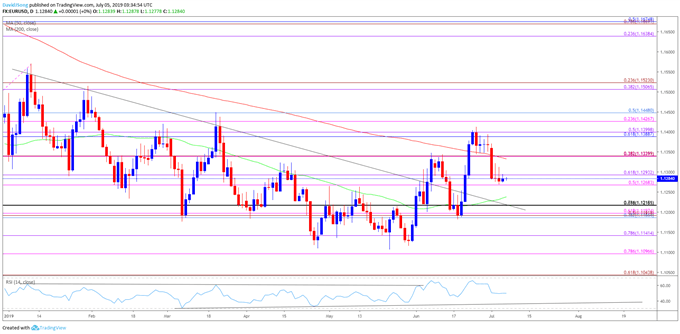

EUR/USD Rate Daily Chart

- Broader outlook for EURUSD is no longer tilted to the downside as both price and the Relative Strength Index (RSI) break out of the bearish formations from earlier this year.

- As a result, EURUSD stands at risk for a larger correction as it breaks out of the range-bound price action from May following the failed attempt to test the 1.1000 (78.6% expansion) handle, with the exchange rate clearing the 200-Day SMA (1.1330) for the first time since in over a year.

- The pullback from the June-high (1.1412) appears to be stalling ahead of the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion) as EURUSD struggles to extend the series of lower highs and lows from earlier this week, with a move back above 1.1340 (38.2% expansion) bringing the 1.1390 (61.8% retracement) to 1.1400 (50% expansion) region on the radar.

- Next area of interest comes in around 1.1430 (23.6% expansion) to 1.1450 (50% retracement), which lines up with the March-high (1.1448), followed by the 1.1510 (38.2% expansion) to 1.1520 (23.6% expansion) zone.

For more in-depth analysis, check out the 3Q 2019 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.