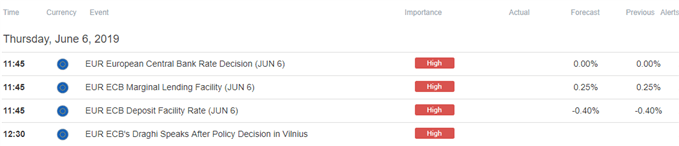

Trading the News: European Central Bank (ECB) Interest Rate Decision

The European Central Bank (ECB) interest rate decision may fuel the recent pullback in EURUSD as the Governing Council continues to pursue its monetary easing cycle.

The ECB meeting may influence the near-term outlook for EURUSD as there appears to be a growing discussion at the central bank to implement a negative interest rate policy (NIRP) on the Main Refinance Rate, its flagship benchmark for borrowing costs.

It seems as though the Governing Council will continue to rely on its non-standard measures to insulate the Euro-area as “slower growth momentum is expected to extend into the current year,” and a dovish forward guidance for monetary policy is likely to weigh on the Euro Dollar exchange rate as it boosts speculation for a more accommodative stance.

However, the ECB may merely attempt to buy more as the central bank prepares to launch another round of Targeted Long-Term Refinance Operations (TLTRO), and a more bullish scenario may materialize for EUR/USD if President Mario Draghi and Co. stick to the same script.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

Impact that the ECB interest rate decision had on EUR/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

APR 2019 | 04/10/2019 11:45:00 GMT | 0.00% | 0.00% | -23 | -5 |

April 2019European Central Bank (ECB) Interest Rate Decision

EUR/USD 15-Minute Chart

As expected, the European Central Bank (ECB) stuck to the zero interest rate policy (ZIRP) in April, with the central bank largely endorsing a dovish forward guidance as “the Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation continues to move towards the Governing Council’s inflation aim in a sustained manner.”

It seems as though the ECB will keep the door open to further support the monetary union as “the risks surrounding the euro area growth outlook remain tilted to the downside,” and the Governing Council may continue to push monetary policy into uncharted territory as the central bank struggles to achieve its one and only mandate for price stability.

The Euro struggled to hold its ground following the dovish comments, but the market reaction was short-lived, with EURUSD bouncing back from a low of 1.1230 to close the day at 1.1274. Learn more with the DailyFX Advanced Guide for Trading the News.

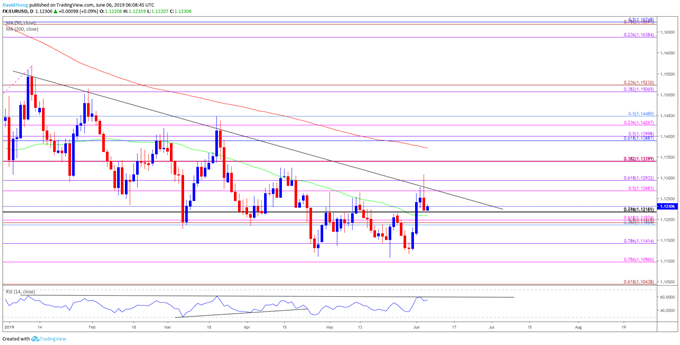

EUR/USD Rate Daily Chart

- Keep in mind, the broader outlook for EURUSD remains tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish formations from earlier this year.

- Moreover, the near-term outlook mired by the failed attempt to hold above the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion), with EURUSD failing to extend the series of higher highs from the previous week.

- In turn, a move below the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) area raises the risk for a move towards 1.1140 (78.6% expansion), with the next downside region of interest coming in around the 1.1100 (78.6% expansion) handle.

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.