Trading the News: U.K. Consumer Price Index (CPI)

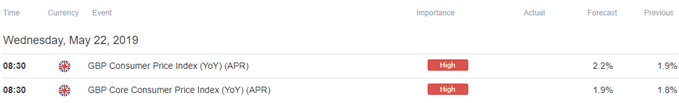

Updates to the U.K. Consumer Price Index (CPI) may curb the recent decline in GBP/USD as both the headline and core rate of inflation are projected to pick up in April.

Signs of sticky price growth may trigger a bullish reaction in the British Pound as it puts pressure on the Bank of England (BoE) to respond to above-target inflation, and Governor Mark Carney & Co. may keep the door open to implement higher interest rates as ‘the Committee continues to judge that, were the economy to develop broadly in line with its Inflation Report projections, an ongoing tightening of monetary policy over the forecast period, at a gradual pace and to a limited extent, would be appropriate to return inflation sustainably to the 2% target at a conventional horizon.’

However, another below-forecast reading for both the headline and core CPI may keep GBP/USD under pressure as it encourages the BoE to retain a wait-and-see approach for monetary policy, with the British Pound at risk of facing headwinds ahead of the next meeting on June 20 as indications of limited price growth dampen bets for a BoE rate-hike.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the U.K. CPI report had on GBP/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAR 2019 | 04/17/2019 08:30:00 GMT | 2.0% | 1.9% | -11 | -8 |

March 2019 U.K. Consumer Price Index (CPI)

GBP/USD 10-Minute Chart

The U.K. Consumer Price Index (CPI) was unchanged in March, with the headline reading steady at 1.9% per annum, while the core rate of inflation crossed the wires at 1.8% for the second month. A deeper look at the report showed Transportation costs climbing to 3.3% from 3.1% per annum in February, while prices for clothing/footwear contracted 1.6% during the same period.

The below-forecast prints spurred a small pullback in GBP/USD, with the exchange rate consolidating throughout the day to close at 1.3038. Learn more with the DailyFX Advanced Guide for Trading the News.

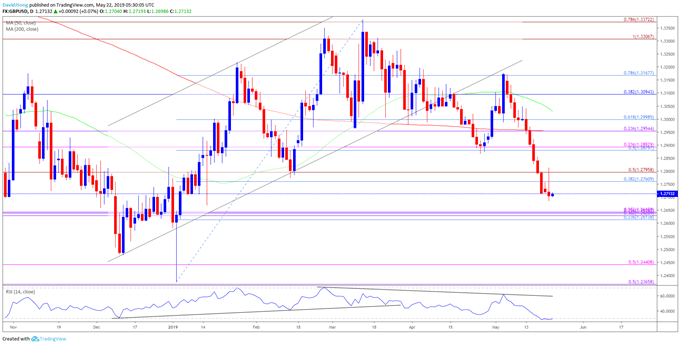

GBP/USD Rate Daily Chart

- Keep in mind, the broader outlook for GBP/USD is no longer bullish as the exchange rate snaps the upward trend from late last year after failing to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

- In turn, the advance from the 2019-low (1.2373) may continue to unravel as the Relative Strength Index (RSI) highlights a similar dynamic, with the oscillator now tracking the bearish formation carried over from March.

- The break/close below the Fibonacci overlap around 1.2760 (38.2% retracement) to 1.2800 (50% expansion) brings the 1.2610 (23.6% retracement) to 1.2640 (38.2% expansion) region on the radar, but will keep a close eye on the RSI as it struggles to push into oversold territory, with failure to hold below 30 raising the risk for a rebound in the exchange rate.

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.