Trading the News: Australia Wage Price Index (WPI)

Another 2.3% print for Australia’s Wage Price Index (WPI) may do little to curb the recent decline in AUD/USD as it puts pressure on the Reserve Bank of Australia (RBA) to implement a rate-cut in 2019.

The RBA may continue to strike a dovish tone at the next meeting on June 4 amid the threat for below-target price growth, and the central bank may take additional steps to insulate the economy as ‘a further improvement in the labour market was likely to be needed for inflation to be consistent with the target.’ In turn, signs of subdued wage growth may produce headwinds for the Australia dollar as it spurs bets for an imminent rate-cut, and the central bank may have little choice but to reestablish its easing-cycle especially as the U.S. and China, Australia’s largest trading partner, struggle to reach a trade deal.

However, an unexpected pickup in the WPI may generate a short-term rebound in AUD/USD as it encourages Governor Philip Lowe & Co. to be patient and retain a wait-and-see approach for monetary policy. Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

Impact that Australia’s WPI had on AUD/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

4Q 2018 | 02/20/2019 00:30:00 GMT | 2.3% | 2.3% | -1 | -4 |

4Q 2018 Australia Wage Price Index (WPI)

AUD/USD 10-Minute Chart

Australia’s Wage Price Index (CPI) held steady at 2.3% in the fourth-quarter of 2018, with the gauge indicating a 0.5% expansion on a quarter over quarter basis amid projections for a 0.6% print. A deeper look at the report showed wages in arts and recreation services increasing 2.8% compared to the 2.3% expansion in the third-quarter, while earnings for IT telecommunications narrowed to 1.5% from 1.8% during the same period.

The mixed prints sparked a limited reaction in the Australian dollar, with AUD/USD largely consolidating throughout the day to close at 0.7164. Learn more with the DailyFX Advanced Guide for Trading the News.

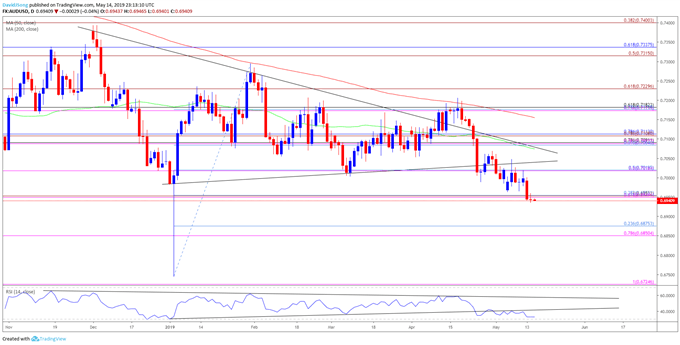

AUD/USD Rate Daily Chart

- The AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7156), with the exchange rate marking another failed attempt to break/close above the moving average in April.

- AUD/USD may continue to give back the rebound from the 2019-low (0.6745) as the wedge/triangle formation in both price and the Relative Strength Index (RSI) unravels, with the break/close below the 0.6950 (61.8% expansion) area opening up the Fibonacci overlap around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) followed by the 0.6730 (100% expansion) area.

- Will keep a close eye on the RSI as it approaches oversold territory, with a break below 30 raising the risk for a further decline in the exchange rate as the bearish momentum gathers pace.

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.