Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

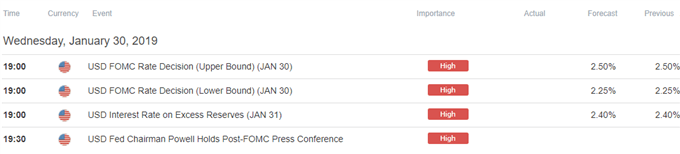

The Federal Reserve’s first interest rate decision for 2019 may generate a mixed reaction in the U.S. dollar as the central bank is expected to keep the benchmark interest rate in its current threshold of 2.25% to 2.50%.

It seems as though the Federal Open Market Committee (FOMC) is gradually changing its tune after delivering four rate-hikes in 2018 as officials see ‘growth moderating ahead,’ and fresh comments from Chairman Jerome Powell & Co. may drag on the greenback should the central bank show a greater willingness to conclude the hiking-cycle ahead of schedule. In turn, a less-hawkish forward-guidance may generate a more pronounced rebound in EUR/USD as market participants scale back bets for an imminent rate-hike, but it remains to be seen if the FOMC will adjust the $50B/month in quantitative tightening (QT) amid little to no signs of a recession.

With that said, the U.S. dollar may face a more bullish fate as long as the FOMC indicates a further reduction in the balance sheet, and the central bank may continue to prepare U.S. households and business for a less-accommodative stance as ‘members generally judged that the economy had been evolving about as they had anticipated.’ Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the FOMC rate decision had on EUR/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

DEC 2018 | 12/19/2018 19:00:00 GMT | 2.25% to 2.50% | 2.25% to 2.50% | -52 | -54 |

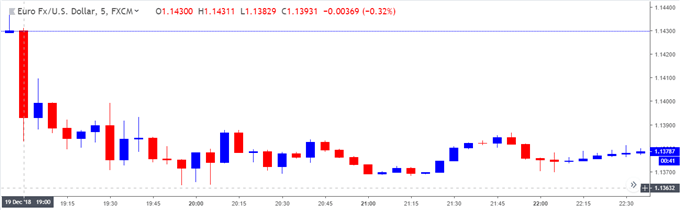

December 2018 Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Open Market Committee (FOMC) delivered a 25bp rate-hike at its last meeting for 2018 to push the benchmark interest rate to a fresh threshold of 2.25% to 2.50%. The accompanying policy statement suggests the Fed will continue to pursue its hiking-cycle in 2019 as ‘the Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

The U.S. dollar gained ground following the Fed rate-hike, with EUR/USD slipping below the 1.1400 handle to close the day at 1.1376. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

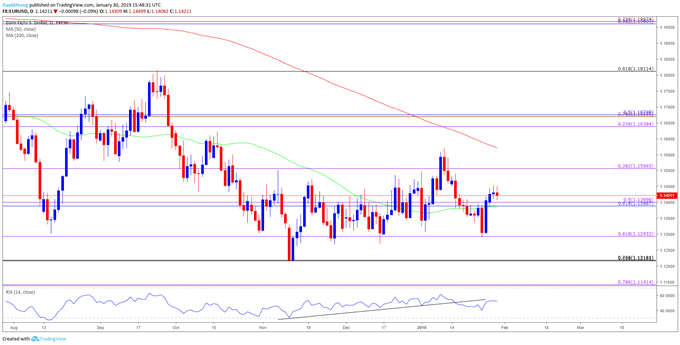

EUR/USD Daily Chart

- Keep in mind, the near-term outlook remains constructive as EUR/USD took out the November-high (1.1500), with the 1.1290 (61.8% expansion) offering near-term support.

- Need a move back above the 1.1510 (38.2% expansion) hurdle to open up the Fibonacci overlap around 1.1640 (23.6% expansion) to 1.1680 (50% retracement), with the next region of interest coming in around 1.1810 (61.8% retracement), which largely lines up with the September-high (1.1815).

For more in-depth analysis, check out the 1Q 2019 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.