Trading the News: Australia Employment Change

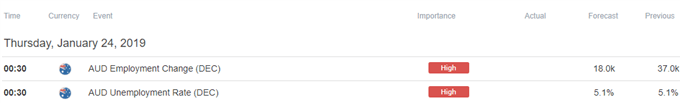

Updates to Australia’s Employment report may do little to alter the near-term outlook for AUD/USD as the economy is anticipated to add 18.0K jobs in December.

Signs of easing job growth may drag on the Australian dollar as it clouds the economic outlook, and the Reserve Bank of Australia (RBA) may continue to endorse a wait-and-see approach at the next meeting on February 5 as ‘there was no strong case for a near-term adjustment in monetary policy.’

However, another above-forecast print along with a pickup in the Participation Rate may put pressure on Governor Philip Lowe & Co. to lift the official cash rate (OCR) off of the record-low especially as discouraged workers return to the labor force. In turn, a positive development may spark a bullish reaction in AUD/USD as it spurs bets for an RBA rate-hike in 2019. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that Australia Employment report has had on AUD/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

NOV 2018 | 12/20/2018 00:30:00 GMT | 20.0K | 37.0K | +5 | -4 |

November 2018Australia Employment Change

AUD/USD 5-Minute Chart

Australia added another 37.0K jobs in November, while the Unemployment Rate unexpectedly climbed to 5.1% from 5.0% per annum in October as the Participation Rate increased to 65.7% from a revised 65.5% during the same period. A deeper look at the report showed the expansion was led by a 43.4K rise in part-time employment, while full-time positions narrowed 6.4K following the 39.5K expansion in October.

Nevertheless, the reaction to the better-than-expected Employment report was short-lived, with AUD/USD consolidating throughout the day to close at 0.7106. Learn more with the DailyFX Advanced Guide for Trading the News.

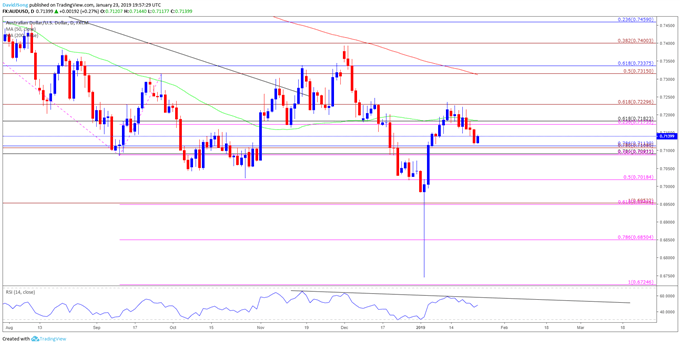

AUD/USD Daily Chart

- The AUD/USD rebound following the currency market flash-crash unravels following the failed attempt to close above the 0.7230 (61.8% expansion) region, and recent developments in the Relative Strength Index (RSI) casts a bearish outlook for the exchange rate as the oscillator responds to the bearish formation carried over from late-2018.

- In turn, a break/close below the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) area raises the risk for a move back towards 0.7020 (50% expansion, which largely lines up with the 2018-low (0.7021), with the next region of interest coming in around 0.6850 (78.6% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.