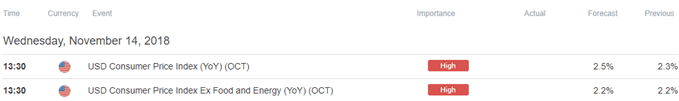

Trading the News: U.S. Consumer Price Index (CPI)

Updates to the U.S. Consumer Price Index (CPI) may undermine the recent rebound in EUR/USD as the headline reading is expected to climb 2.5% in October after expanding 2.3% per annum the month prior.

Signs of heightening price pressures is likely to heighten the appeal of the greenback as it encourages the Federal Reserve to deliver a 25bp rate-hike in December, and the ongoing shift in U.S. trade policy may push Chairman Jerome Powell & Co. to extend the hiking-cycle as ‘several participants reported that firms in their Districts that were facing higher input prices because of tariffs perceived that they had an increased ability to raise the prices of their products.’

In turn, a material uptick in the CPI may trigger a bullish reaction in the dollar, but a batch of lackluster data prints may fuel a larger rebound in EUR/USD as it saps bets for above-neutral interest rates. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the U.S. CPI report has had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

SEP 2018 | 10/11/2018 12:30:00 GMT | 2.4% | 2.3% | -2 | +23 |

September 2018 U.S. Consumer Price Index (CPI)

EUR/USD 5-Minute Chart

The U.S. Consumer Price Index (CPI) slowed more-than-expected in September, with the headline reading narrowing to 2.3% from 2.7% per annum in August, while the core rate of inflation held steady at 2.2% for the second month amid projections for a 2.3% print. A deeper look at the report showed the weakness was led by a 0.5% decline in energy prices, with transportation costs also narrowing 0.3% in September, while prices for apparel increased 0.9% after contracting 1.6% the month prior.

The greenback struggled to hold its ground following the batch of lackluster data prints, with EUR/USD largely advancing throughout the session as the exchange rate closed the day at 1.1593. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

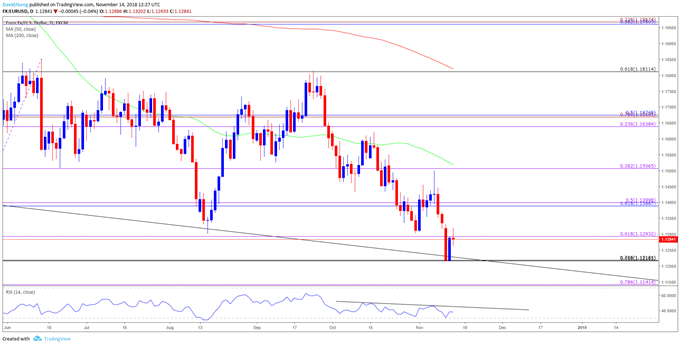

EUR/USD Daily Chart

- Keep in mind, broader outlook for EUR/USD remains capped by the 1.1810 (61.8% retracement) hurdle, with the exchange rate at risk for further losses as it snaps the August-low (1.1301).

- Need a break/close below the 1.1220 (78.6% retracement) area to open up the next downside target around 1.1140 (78.6% expansion).

- However, the recent series of higher highs & lows raises the risk for a near-term rebound, with a close above 1.1290 (61.8% expansion) raising the risk for a move back towards 1.1390 (61.8% retracement) to 1.1400 (50% expansion).

For more in-depth analysis, check out the Q4 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.