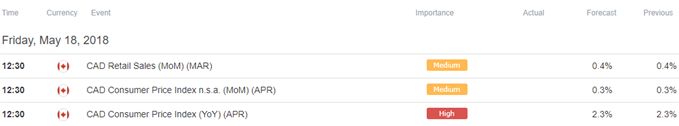

Trading the News: Canada Consumer Price Index (CPI)

A 0.4% rise in Canada Retail Sales paired with another 2.3% print for the Consumer Price Index (CPI) may continue to foster range-bound prices in USD/CAD as it does little to alter the outlook for monetary policy.

Recent comments from the Bank of Canada (BoC) suggests the central bank will look through the stickiness in price growth as ‘the transitory impact of higher gasoline prices and recent minimum wage increases will likely cause inflation in 2018 to be modestly higher than the Bank expected in its January Monetary Policy Report (MPR),’ and Governor Stephen Poloz and Co. may stick to the sidelines at the next meeting on May 30 as ‘some monetary policy accommodation will still be needed to keep inflation on target.’ With that said, a set of lackluster data prints may fuel a larger rebound in USD/CAD as it encourages the BoC to retain the current policy for the foreseeable future.

However, an batch of above-forecast reading may undermine the recent rebound in USD/CAD as it puts pressure on the BoC to further normalize monetary, and the pair may ultimately threaten the range-bound price action from earlier this year as market participants boost bets for an imminent rate-hike.

Impact that Canada CPI has had on USD/CAD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAR 2018 | 04/20/2018 12:30:00 GMT | 2.4% | 2.3% | +87 | +134 |

March 2018 Canada Consumer Price Index (CPI)

USD/CAD5-Minute Chart

Canada’s Consumer Price Index (CPI) showed a marginal rise in March, with the headline reading climbing to an annualized 2.3% from 2.2% the month prior. A deeper a look at the report showed Transportation prices increasing 5.3% per annum to lead the advance, with the cost for healthcare also climbing an annualized 2.3%, while prices for clothing/footwear narrowed 0.1%during the same period.

The below-forecast print dragged on the Canadian dollar, with USD/CAD climbing above the .12700 handle to end the day at 1.2765. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

USD/CAD Daily Chart

- The recent rebound in USD/CAD may continue to unravel as it produces a failed attempt to test the monthly-high (1.2998), and the bearish tilted in the Relative Strength Index (RSI) raises the risk for a larger pullback in dollar-loonie as the exchange rate cares a fresh series of lower highs & lows.

- Break/close below the 1.2720 (38.2% retracement) to 1.2770 (38.2% expansion) region opens up the next area of interest around 1.2620 (50% retracement), with the next downside hurdle coming in around 1.2440 (23.6% expansion) to 1.2510 (78.6% retracement), which sits just beneath the April-low (1.2527).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.